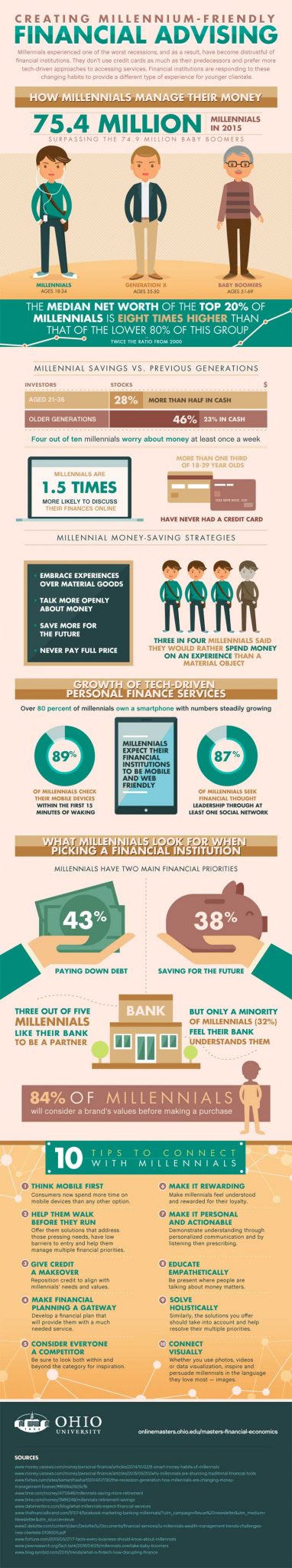

Infographic: creating millennium-friendly financial advising

People often need financial advice that’s best suited to meet their needs, which differ from one generation to another. You cannot expect millennials to consume the same financial advice as baby boomers.

Times have changed, so financial institutions and experts also need to change their approaches to cater for the needs of a much younger clientele that’s distrustful of not only the government, but also financial institutions.

Millennials are also tech-driven and they do not use credit cards as much as their predecessors. This is partly due to the fact that they have first-hand experience of one of the worst recessions in history.

To learn more, check out this nifty infographic, created by Ohio University’s online Master of Financial Economics programme.

How millennials manage their money

In 2015, the number of millennials stood at 75.4 million while the number of baby boomers stood at 74.9 million. Millennials are described as anyone who is between 18 to 34 years old. Baby boomers, on the other hand, are between 51 to 69 years old. Between the two age groups is Generation X, which is made up of individuals who are 35 to 50 years old.

According to recent statistics, the median net worth of the top 20% of millennials is eight times higher than that of the lower 80% of this group. This is twice the ratio reported in the year 2000. Millennials also have a different saving culture compared to their predecessors. For instance, investors aged between 21 to 36 years of age hold more than half of their portfolio in cash with only 28% going into stocks. Older generations, on the other hand, held only 23% of their portfolio in cash with 46% going into stocks. It has also been revealed that 40% of millennials worry about their finances at least once a week.

Research studies have revealed that millennials are 1.5 times more likely to discuss their finances online. What is shocking is that a third of consumers aged between 18 to 29 years old have never had a credit card.

How millennials spend their money

While it might have been taboo for baby boomers to talk openly about money, millennials discuss the topic openly and in depth. They also embrace experiences over material goods when it comes to spending their money. They save for the future and never pay the full price for anything. A recent study found that three in four millennials would rather spend their money on an experience than on a material object.

Growth of tech-driven personal finance services

Over 80% of millennials own a smartphone and the number is steadily increasing. Over 89% of millennials usually check their mobile devices within the first 15 minutes of waking up. They also expect their financial institutions to be mobile and web-friendly. On the other hand, over 87% of millennials seek financial thought leadership through at least one social network.

What millennials look for when picking a financial institution

Millennials have two main financial priorities; paying off their student loans and other debts, and saving for the future. On average, they spend 43% of their income to pay down their debts and put away 38% of their income as savings for the future.

Three out of five millennials would like their bank to be a financial partner as opposed to just another business that feeds off their sweat. This means tailoring products to meet their needs and loosening up some of their strict terms and conditions. After all, the relationship can be beneficial to both parties without any of them feeling like they’re getting a raw deal.

What is shocking is that only 32% of millennials feel like their bank understands them. This is largely due to the fact that banks and other financial providers still offer solutions to meet the needs of baby boomers.

Before making a purchase, 84% of millennials always consider the values of a business or brand. If they are not in line with their own values, they always shop around for a more suitable brand.

Source: Ohio University