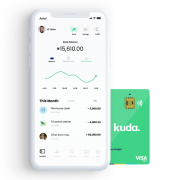

Digital Nigerian bank Kuda raises $1.6m in pre-seed funding

Nigerian fintech start-up Kuda has raised $1.6 million in pre-seed funding following its recent beta launch as a digital bank.

The round saw participation from Startupbootcamp (the AfriTech accelerator programme that Kuda joined last year), as well as from angel investors Haresh Aswani of Tolaram Group and Ragnar Meitern.

The three-year-old fintech started out as the lending platform Kudimoney

The three-year-old fintech started out as the lending platform Kudimoney, but in June of this year it re-branded to Kuda and secured its banking licence from the Central Bank of Nigeria (CBN). It is the first mobile-first bank in the country.

“Kuda’s vision of democratising financial services and making it easily accessible and affordable for all Africans aligns with my philosophy on transforming industries and value creation,” says Aswani. “The founders of Kuda are extremely smart and knowledgeable about the space.”

The digital bank offers a free banking platform, a debit card, an app which tracks spending and the lowest transfer rates in the Nigeria – with a look to offer consumer savings and P2P payments in the coming months.

Kuda’s co-founder and CEO, Babs Ogundeyi, says the mobile-first bank is built “to address the serious pain points for the world’s most mobile centric consumers”.

Ogundeyi adds: “We are building a radically different type of bank that puts consumers back in control of their finances.”