FinovateFall 2019: AI, ML, robotics and digital first

I recently spent three exciting days at FinovateFall 2019 in New York witnessing the latest and greatest from over 70 fintechs. As a first-time attendee, I enjoyed the innovative format exhibitors used of more “showing” and less “telling” with seven-minute demos of specific use cases: which left the audience with a quick snapshot of what each fintech helps solve and how.

The event included a healthy mix of early and late stage fintechs, as well as financial institutions, vendors and investors. There were several interesting key notes containing key themes that included data driven personal finance, machine learning (ML) and artificial intelligence (AI), robotics and digital first. Let’s dive a little deeper into each of them!

Data driven personal finance

Several providers were able to link different data sets and provide an interface that helps consumers plan their financial lives. Significantly more advanced than the individual calculators that we have gotten used to on websites to calculate a loan payment based on a loan amount and interest rate, this was an integrated approach to creating a picture of a consumer’s finances and how different life events impact their financial well-being. Very cool!

Most consumers don’t like to spend a lot of time on financial decisions (not many people are excited about getting loan, they are excited about what they are getting the loan for) and many people procrastinate when it comes to their personal finances, so it is crucial that personal finance tools are easy to use and provide immediate insight. In the demo by InterGen, for example, data showed us how using AI can help create a cash flow forecasted model that shows the financial impact of upcoming life events.

AI, ML and deep learning

These buzzwords come up a lot at conferences and, no surprise, came up a lot at Finovate. I think for AI, ML and deep learning to be successful, you need to guide ML to understand the right concept using the right data. Many financial institutions find themselves in a situation where they have a lot of data about their customers, but don’t know how to apply ML or AI to the data, or the initial results are disappointing.

At this year’s FinovateFall, we witnessed some great examples of how fintechs have successfully applied ML and AI to specific consumer finance challenges and how they provide a great opportunity for financial institutions to partner with or learn from the experience.

Conversational AI

Bots have come a long way in their conversational capabilities! They can now deal with more messy conversation (Clinc) and direct you to another bot if they can better help you (boost.ai). They are even getting certified to provide financial advice. The experience is getting better for the consumer and it is starting to feel more like a human conversation.

A key term that came up several times was “intent”. In a chatbot set-up, it is important to first understand what the consumer is trying to solve for and how to best structure the conversation to get to the right solution.

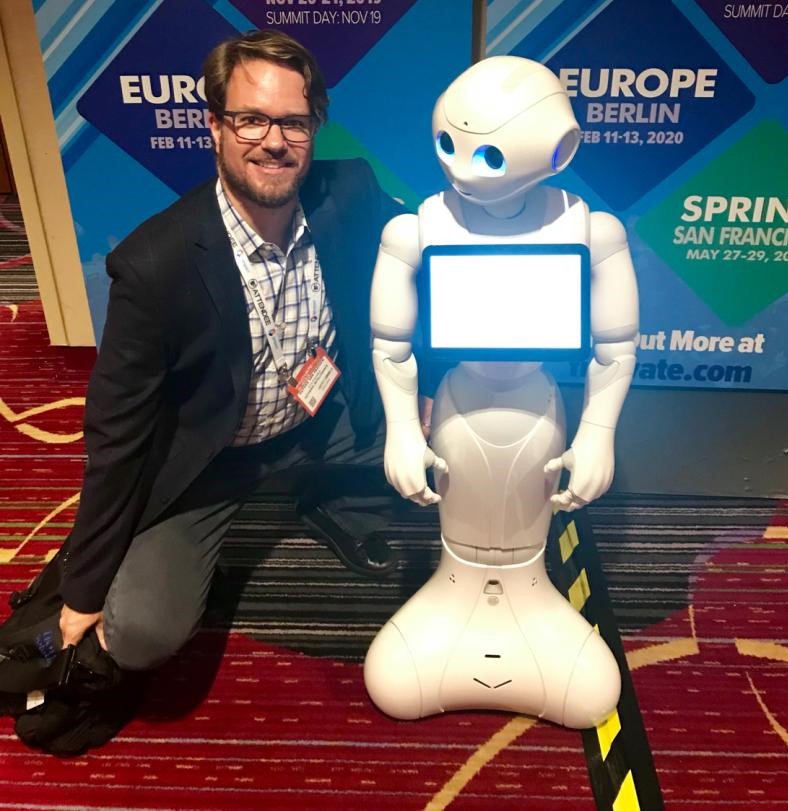

Robotics in branches

From the experience with Pepper the Robot presented by Jeremy Balkin, head of Innovation at HSBC, we learned that there are a set of questions that can be answered by a robot which free up branch staff for more complex conversations (not replacing them). In the HSBC case, Pepper also provided a clear business case for robotics, Balkin claimed, as the bank is seeing a sustained increase in business revenue in the branches that have Pepper. An additional upside is the engagement from the bank staff and the “fun factor” customers are experiencing that get to engage with this robot, he said. An encouraging first step towards seeing customers love banking again.

Digital first

With more and more consumers choosing digital as their first (and sometimes only) channel to engage with financial services providers, it has become crucial to rethink what “digital first” means. It certainly is NOT taking an offline process and putting it on a website. It is all about designing a process that solves a personal finance problem leveraging the strengths of the digital channel and aligning to the different customer expectations. Consumers might be OK waiting several minutes in a branch to transact or get their question answered, but when going to a website or using chat on a mobile device that same wait time would be unacceptable.

A great example of a digital first approach, in my view, is Better.com, a direct lender dedicated to providing a fast, transparent digital mortgage experience backed by superior customer support. My favorite presentation at FinovateFall was by Better.com CEO Vishal Garg who explained how his frustration with the home financing process was the catalysts for him start his company.

Three action packed days with lots of great, insightful demos and practical learnings, facilitating valuable conversations between fintechs, financial institutions and investors. I am already looking forward to the next edition of Finovate – see you there!

By Rutger van Faassen, VP of consumer lending at Informa Financial Intelligence

This post was originally published on LinkedIn