Meniga lands $9.4m from Groupe BPCE, UniCredit and Crédito Agrícola

Meniga, an Iceland and UK-based digital banking and personal financial management (PFM) software provider, has landed $9.4 million (€8.5 million) in a strategic investment round led by new backer Groupe BPCE, France’s second-largest banking group.

Groupe BPCE has been one of Meniga’s largest customers since 2018 with 36 million customers, and will be extending this partnership to one involving equity as well as digital services.

To date, Meniga’s services span roughly 90 million consumers through its banking clients

The round also saw participation from new investor Grupo Crédito Agrícola, one of Portugal’s main banking groups, and existing backer UniCredit, one of Italy’s biggest banks by assets.

Other investors included Five Degrees-backer Velocity Capital, Nordic venture capital firm Industrifonden, and Iceland-based Frumtak Ventures.

The fintech says it will use the fresh funding to underpin its research and development activities, and boost its sales and service teams to “meet growing demand” which it says has been driven predominantly by the advances made in open banking across the globe.

Meniga’s services span roughly 90 million consumers through its banking clients, which are based across 30 countries. Last year, the start-up opened new offices in Barcelona and Singapore, adding to its presence in London, Reykjavik, Stockholm, Helsinki and Warsaw.

Read more: Meniga and Worldline strike digital banking partnership

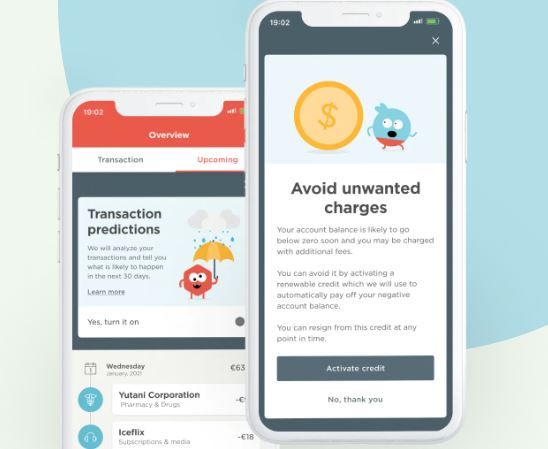

Meniga‘s products includes data aggregation technologies, personal and business finance management solutions (PFM), cashback rewards and transaction-based carbon insights.

“Together, we have laid the groundwork for continued digital innovation,” says Groupe BPCE

“Our partnership with Meniga has been extremely positive to date,” says Groupe BPCE’s chief digital and data officer Yves Tyrode.

Fellow customer and new strategic investor Crédito Agrícola, which has 1.5 million customers, launched its new banking app, powered by Meniga, called ‘moey!’ last September.

For existing backer UniCredit, which first invested in Meniga in 2018, this round marks its second strategic investment.

“We believe in fostering long-term relationships with the best fintechs in the market in order to continue developing innovative products and services with tangible benefits for our clients,” says UniCredit’s co-CEO of commercial banking in Western Europe, Olivier Khayat.

Read next: Grupo Crédito Agrícola launches new banking app “moey!” with Meniga