Embedded insurance: a $3tn market opportunity, that could also help close the protection gap

- Embedded insurance, part of a broader movement towards embedded finance, is about getting more affordable, relevant and personalised insurance to people when and where they need it most.

- It’s enabled by abstracting insurance functionality into technology so that many more third-party organisations and developers can seamlessly incorporate attractive risk mitigation solutions into their customer journeys.

- For insurers it creates the potential for lower cost distribution to more individuals and firms, access to more data to enhance product innovation and reduced underwriting risks.

- For third party organisations embedded insurance can enhance value propositions and create new revenue streams.

- For investors and tech entrepreneurs it offers opportunities to create valuable new ventures.

- For society at large it helps close the insurance protection gap – the difference between the level of coverage that is economically and socially beneficial and what’s actually bought.

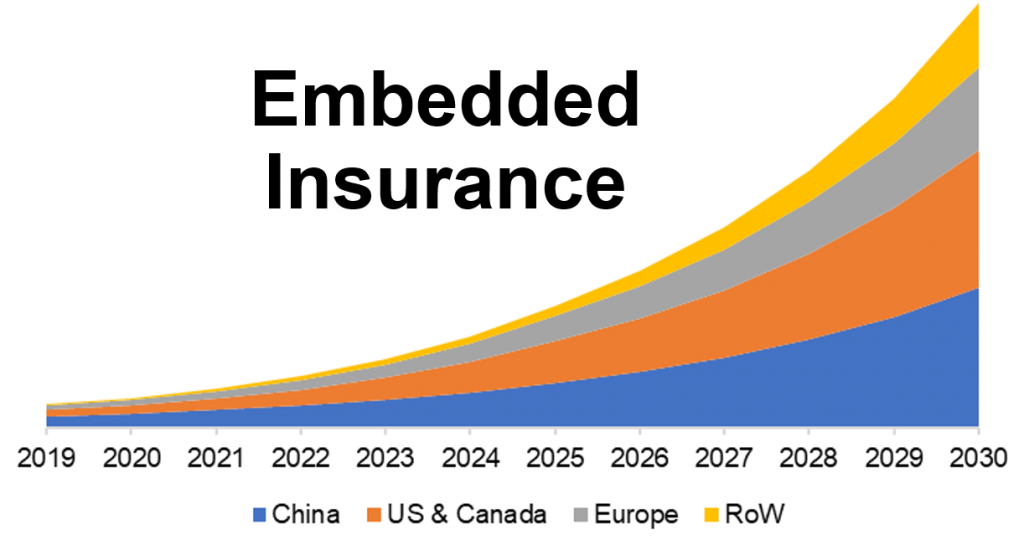

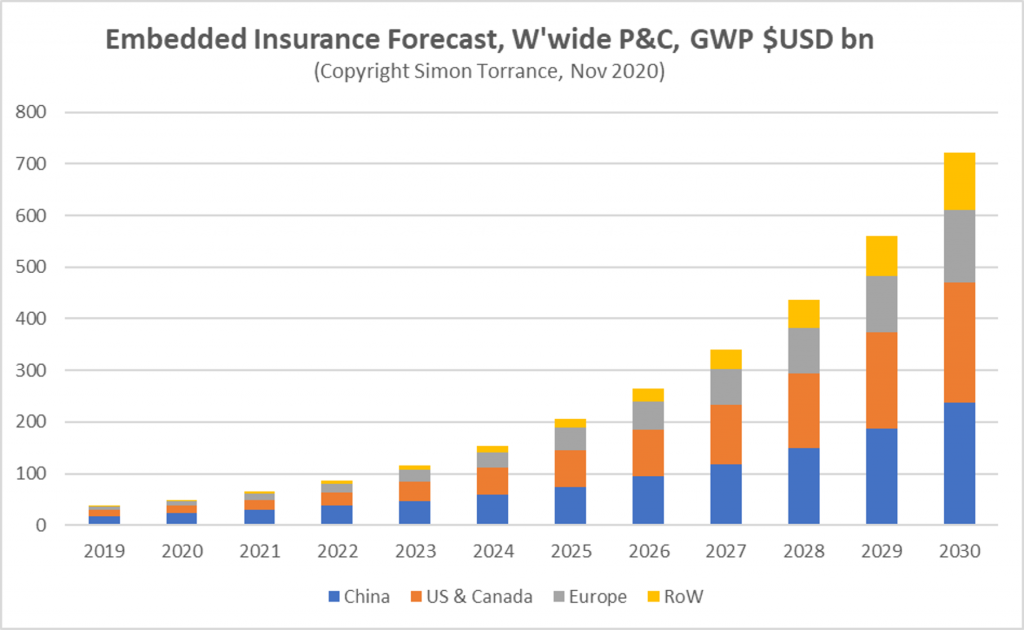

- In property and casualty alone, embedded insurance could account for over $700 billion in gross written premiums by 2030, or 25% of the total market worldwide.

- Including aspects of life and health coverage, at current insurtech multiples embedded insurance could create over $3 trillion in market value…for those who enable it.

- All players – insurers, banks, fintechs, investors, non-financial retailers, product manufacturers, service providers, digital platforms and software companies – should look carefully at this fast-emerging space and define strategies of “where to play” and “how to win“.

This report is split into four sections, and takes about 20 minutes to read:

- Context – insurance is something that nobody wants but everyone needs.

- Embedded insurance – to affinity and beyond.

- The “industry stack” – fragmenting and transforming.

- Market sizing – $700 billion in P&C alone.

- Conclusion – options and actions.

Context – insurance is something that nobody wants but everyone needs

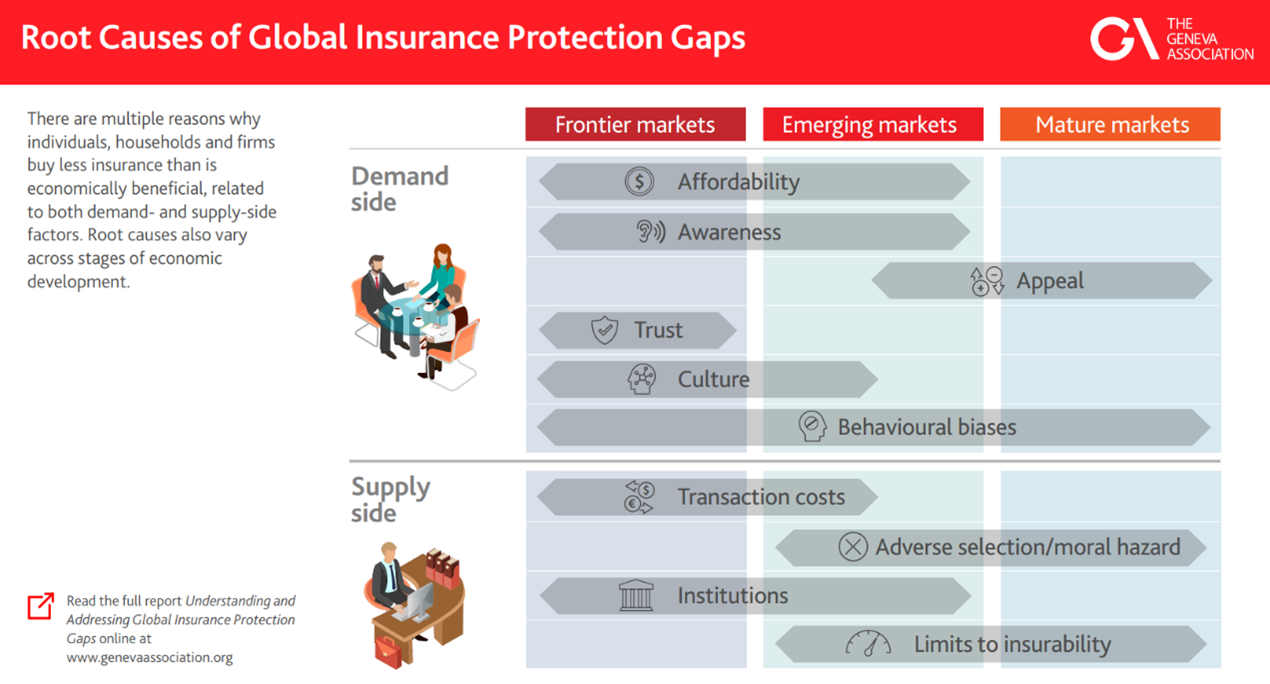

Insurance is needed more than ever today as the “protection gap” – the gap between the amount of insurance that is economically and socially beneficial for individuals, households and firms and the amount of coverage actually bought – is getting wider and wider.

From 2000 to 2020 the protection gap doubled, according to the Swiss Re Institute, driven by global trends in digitisation, urbanisation, climate change and a lack of effective innovation.

In private pensions alone the Geneva Association, an international think tank, estimates that the gap is over $20 trillion worldwide today, i.e. most people cannot afford to live comfortably into old age. And if the main family breadwinner dies today the majority of humanity is not able to maintain its living standards and repay debts. The COVID crisis has exposed and exacerbated this situation.

Source: Mercer Analysis for the World Economic Forum, 2017

If the gap between what’s needed and what’s being bought is so vast, one would think that this is a golden opportunity for the insurance industry.

However, according to McKinsey, 80% of insurers made negligible or negative economic profit in the years running up to the COVID crisis and, projecting forward, the situation is likely to get worse.

What we see is a fundamental weakness in the business model of the insurance industry – an inability to effectively match supply with demand. Why is this?

On the demand side, insurance products are complicated, inflexible, expensive, regularly mis-sold, difficult and annoying to buy (all those forms to fill in), and the benefits to customers are uncertain and distant.

Source: The Geneva Association

On the supply side, related to these issues, the costs of distribution (of selling products to customers who don’t understand, trust or want them) are enormous at roughly 50% of total industry costs. Insurers are expert at managing risk, but their underwriters lack enough rich, real-time data to be able to create affordable and personalised products that can keep pace with market demands, accelerating trends and the new risks that go with them.

Laws and regulations designed for a pre-digital age restrain them further. And the incentives for traditional sales channels reinforce behaviours that do not encourage customer innovation or value.

I live in the UK, one of the most sophisticated insurance markets in the world. Recently I tried to buy car insurance for my 17-year-old son from an insurer I’ve been with for ten years. They offered me an annual policy of £8,000 that was four times the value of the car itself. In the end, I found a provider that offered an app that tracked real-time driving behaviour at a quarter the price. Separately, I thought I needed some specific top-up health cover and got advice from an agent. After I made a claim a year later, the price of the policy went up by more than the cost of the treatment if I’d got it privately. I’ve since cancelled the policy.

My bank knows more about my assets and income than any other organisation but, in spite of open banking regulations in the UK which allow third parties to access my bank account data with my permission, none of my insurers have sought to do so to offer me attractive insurance solutions.

Compared to the 1.7 billion unbanked or the near 50% of the world’s population living on less than $6 per day my protection problems, like yours, are trivial.

The big question then is: how can the insurance industry re-think its business model and deliver greater value to the market, for the benefit of all its stakeholders: individuals, families, firms, its partners, government, and investors, in all corners of the world?

Embedded insurance – to affinity and beyond…

Embedded insurance is emerging as a new way to distribute insurance services efficiently. It doesn’t solve the protection gap, but it addresses many of the supply and demand issues and could act as a catalyst for wider industry business model transformation.

It is part of a broader movement towards embedded finance and goes well beyond today’s approaches to affinity and partner distribution approaches. It is enabled by APIs, modular software and artificial intelligence (AI) as well as the emergence of new innovative intermediaries (described below).

Specifically, embedded insurance means abstracting insurance functionality into technology to enable any third-party product or service provider or developer in any sector to seamlessly integrate innovative insurance solutions into their customer propositions and experiences, either as complementary add-ons to their core offerings or as new native components.

For end users – individuals or businesses – it means simpler and more affordable solutions at the touch of a button, at a moment when it is most relevant. For third parties it means a new way to differentiate, attract or retain users, or generate new sources of revenue.

Let’s look at a few examples.

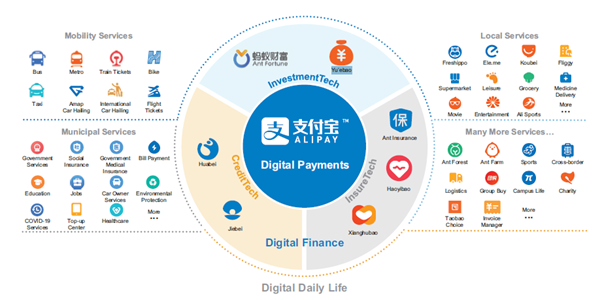

Ant Group manages a digital financial services platform in China with an enormous user base due to the ubiquity of Alipay and the superapp they’ve created around it. In terms of insurance they spotted a large underserved market in low-income rural areas that traditional insurers were ignoring.

Source: Ant Group IPO filing 2020

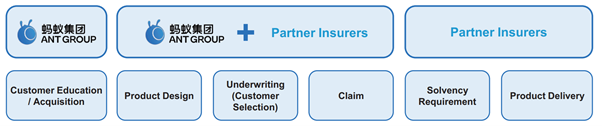

Rather than trying to resell existing insurance products from one or two partners they created their own insurtech platform to connect demand with supply in a new way.

Ant Group focuses on understanding the needs of its consumers, educating them about the value of insurance and then designing compelling solutions for them with its suppliers.

Its insurance partners take on most of the underwriting and regulatory risk and deliver products to Ant’s specification. It now offers 2,000 customised, affordable and flexible life and non-life products from 90 different insurance suppliers.

Source: Tellimer, November 2020

For example “Quanminbao” is a simple pension annuity product with premiums starting from the equivalent of $0.15. Customers receive payment from the Alipay app when they retire. In health, “Haoyibao” provides guaranteed lifetime cancer protection with annual premiums of circa $15 for payouts of $600,000, even for those already diagnosed with cancer or with pre-existing conditions such as diabetes.

Consumers get to understand the value of insurance which increases their adoption and creates opportunities to upsell other solutions with payments and disbursements managed through its superapp platform. They are turning unmet needs into wants.

On the property & casualty (P&C) side Ant’s insurtech solutions are themselves embedded in Alibaba’s Taobao product marketplace, providing shipping returns protection products to small businesses for $0.50. This has increased trust in Alibaba’s platform which has resulted in higher volumes of transactions. Since COVID, Ant has sold 50,000 new business interruption policies to small offline merchants, offering payouts for very short periods of time as they are needed without long-term commitment.

With this embedded strategy Ant is closing the protection gap and, as a result, its insurance arm has become the largest online insurer in China with over 500 million customers. Insurers have benefited from low cost access to a large new customer base, proactive assistance in product innovation, better product pricing, improved underwriting results and enhanced claims management through automated servicing and fraud detection using advanced technologies such as natural language processing (NLP) and machine learning (ML). Ant takes 20% of the revenues, its insurance partners keep 80%.

Similarly, in India, where only 3% of the population have insurance, big digital platforms like Amazon and Paytm are starting to bring affordable protection solutions to the market.

Uber is another big online platform with a close relationship with its users including its three million drivers worldwide.

At any one time, depending on local regulations, competitive threats and new market opportunities, Uber requires the flexibility to provide its drivers with different types of insurance, benefits and incentives, related to vehicle and personal injury cover, sickness, paternity pay or other income loss.

Some of its insurance solutions are provided to drivers for free, some are invisible, some are optional add-ons. Some are related to when the driver is “in service”, some not. Given the size of its driver base, it has the potential to offer more complex products like pensions, life and health insurance in the future, in addition to other financial services like the bank accounts and loans it already offers.

In all cases Uber prides itself on the simplicity of its user experience and requires insurance solutions which are easy to adopt, good value and quick to claim against.

The problem has been that traditional insurers have not been attuned to the need for such flexible, niche products at the speed that Uber moves and within categories that are new to the industry. Drivers are not “employees”, Uber does not own a “fleet”, its drivers don’t want “annual policies”, any downtime is lost income.

As a result, Uber, like other digital native organisations, is increasingly working with a new breed of insurers, such as digital managing general agents (MGAs) and others, who are providing more relevant solutions that can be embedded more easily in their driver experiences. Here’s an example, from the UK, demonstrating a new three-minute digital sign up process:

Like Ant Group, Uber provides insurers with access to a large new market, with very low distribution costs. There is clearly a win, win, win here, for users, insurers and platforms like Uber if business models – and digital capabilities – align.

Retailers and product manufacturers

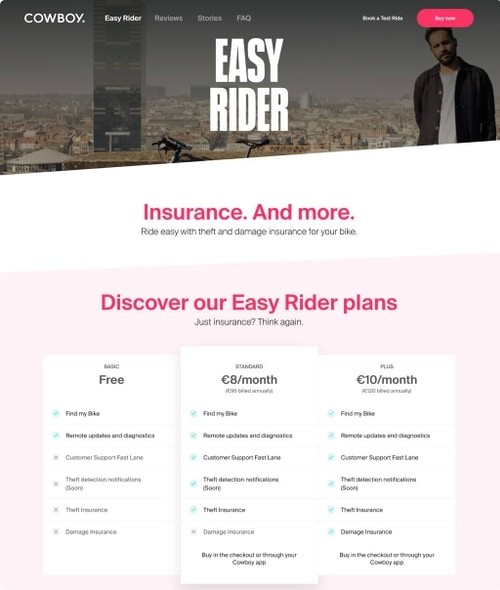

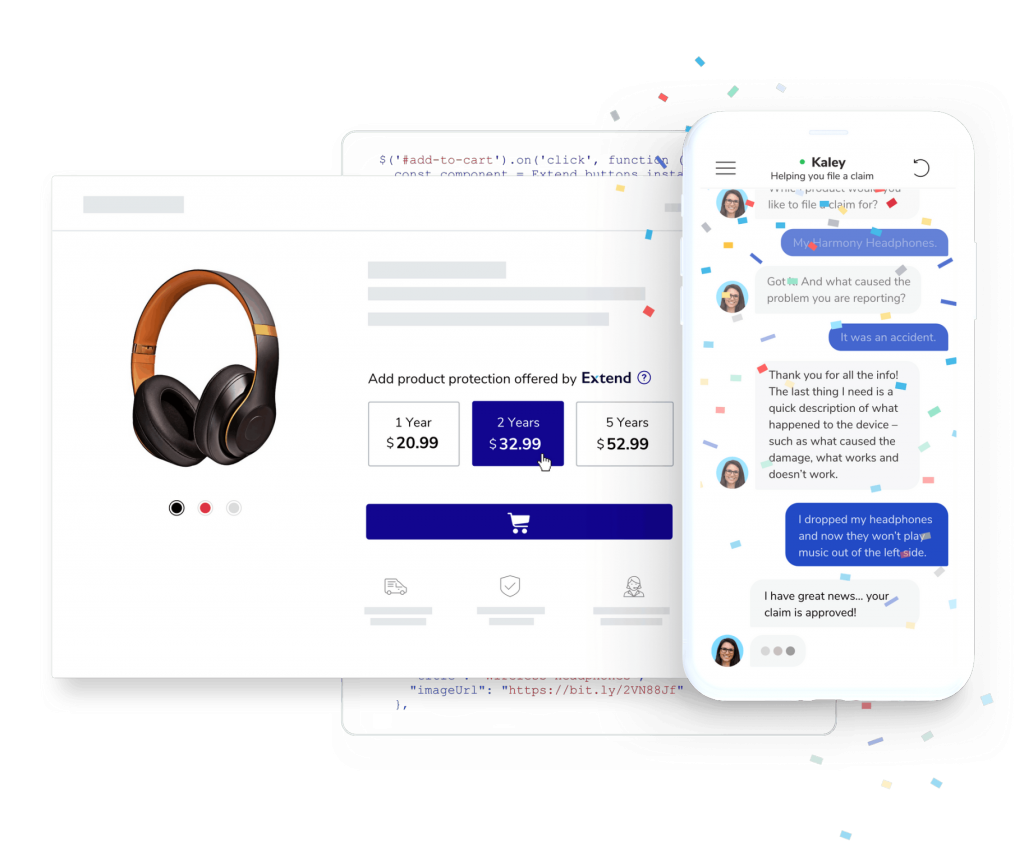

As more business moves online a long tail of smaller retailers and product manufacturers with razor thin margins are looking to offer add-on services like theft and damage protection at point of sale. They need to be tailored to the niche requirements of their customers, affordable and flexible. For some, these sorts of ancillary service can equate to up to 50% of their net profits.

Source: Cowboy bikes and Qover

In the past, due to the technical and contractual complexity of dealing with traditional providers, only the very largest retailers and merchants and could afford to integrate these types of extended warranties and only on large value items. Yet Amazon has found that offering warranties even for $40 backpacks increases their purchase rate. New insurtech intermediaries (described later) are making it easier and cost effective for any online merchant to create similar offers.

Source: Extend embedded warranties

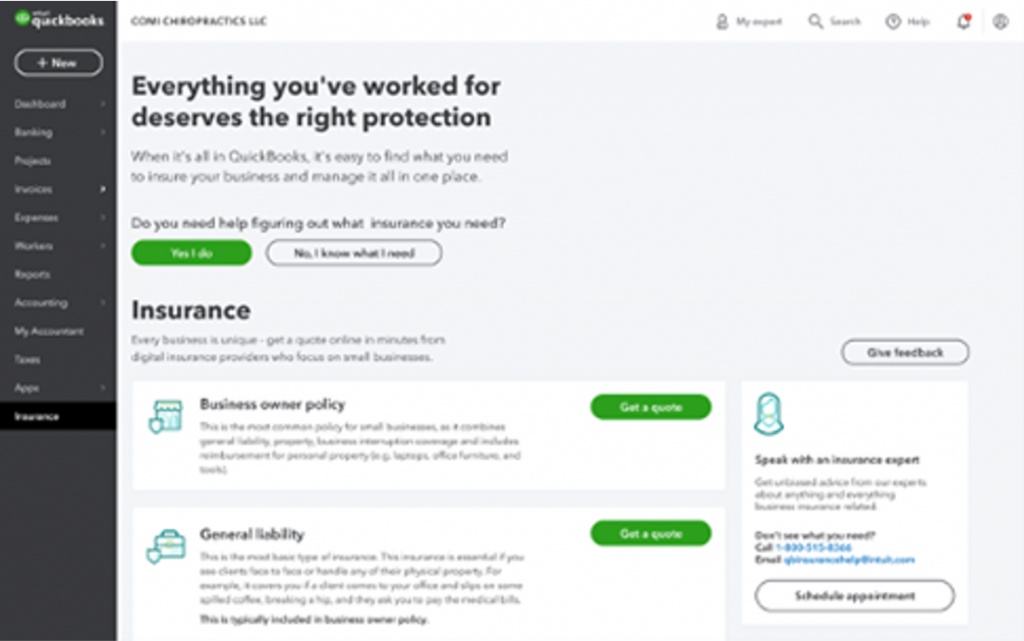

B2B Software-as-a-Service (SaaS) companies like Square, Intuit, Gusto, Xero and Toast provide operational management systems to small businesses in multiple vertical sectors. Given their real-time knowledge of the financial status of their customers they are in a perfect position to add personalised insurance solutions to the range of other financial services they already provide. This adds significant additional revenue for virtually no customer acquisition costs.

Source: Intuit embedded B2B insurance with AP Intego

Embedded insurance is about bringing demand and supply for risk mitigation solutions more closely together within contexts that make insurance more relevant, and therefore more attractive.

To understand the breadth of its potential application into the future we can start to ask ourselves questions such as:

- Who knows more about the risks relating to my health and the most relevant prevention and mitigation interventions? My insurer who asks me a few generic questions every year in return for a 10% discount on my premium, or a new wellness service that processes data from my Fitbit, “23 and Me”, banking transaction data and my medical records (with my consent and control, of course)?

- Who can offer me life cover that pays out based on the real time value of my assets and my family’s indebtedness rather than based on some generalised situation decades in the future? My life insurer, my bank, my investment advisor, my small business accounting software, or some combination?

- If I am a small hold farmer in an emerging market with no bank account and a low income, who is better able to engage with me and my peers about affordable weather or injury protection solutions? An insurer, a broker, my mobile phone operator, a remittance provider, a farming equipment supplier, my utility company, my farming cooperative, or WhatsApp or WeChat?

While retailers, manufacturers, airlines, banks, professional associations and others have been distributors of insurance products for a long time, embedded insurance has the potential to take this to another level.

BIMA is a great example of embedding affordable health insurance into the mobile telephony ecosystem, closing the protection gap for 35 million Africans today. The key stat is this: 75% of these customers are accessing insurance for the first time.

One of BIMA’s customers in Ghana sums it up nicely: “I have a very large family and was unable to work due to a leg injury. As a mason I hardly made enough money and owed creditors GHS 1,200. I filed for a claim and received 1,800. I am very thankful.”

No traditional insurer can anticipate the specific needs of a myriad of niche requirements, and it’s not cost effective for them to try. However, others who are closer to customers can, enabled by new technology.

Let’s look at how this is happening in more detail.

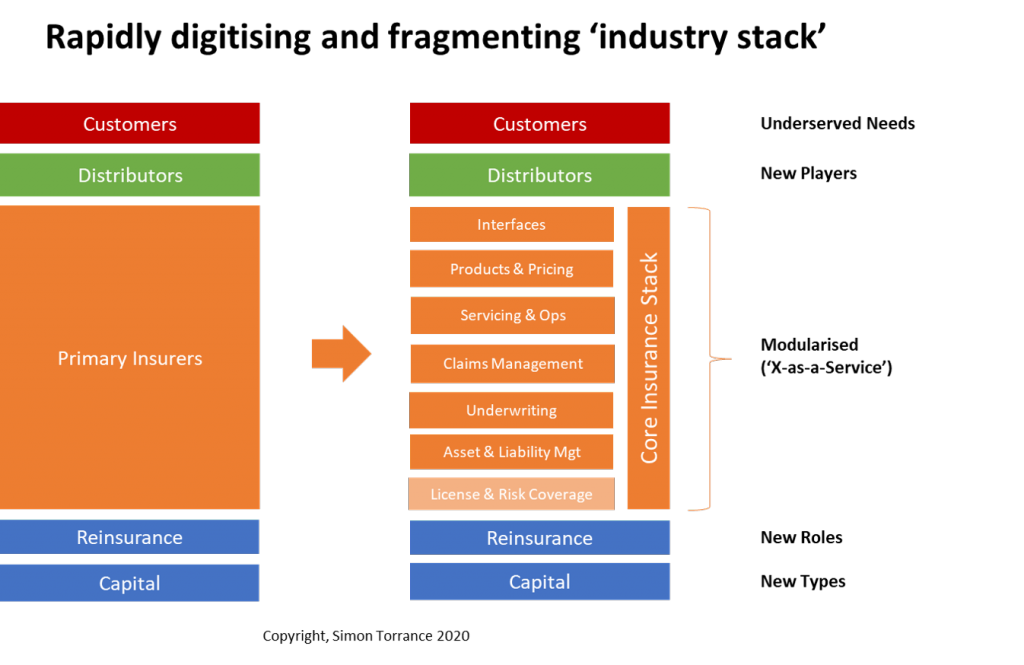

The “industry stack” – fragmenting and transforming

Technology is modularising and then enabling a re-configuration of the insurance value chain. An explosion of insurtech companies is creating better versions of the elements of the “industry stack” that used to be provided just by primary insurers. Investment in this innovation reached a new peak of $2.3 billion and five IPOs in the third quarter of 2020 alone.

As we’ve already seen happening in the banking sector risk capital, solvency and other regulatory obligations can be separated from the stack and made available to the embedded insurance market in the form of Licence-as-a-Service (more on this below).

To understand the impact of this modularisation and how it might play out, let’s look at how the market operates today and how it could evolve.

Traditionally, the majority of insurance was sold through agents, brokers, and in some markets by banks and third party affinity partners, using the phone, face to face methods… and lots of paperwork. Online aggregators became popular in some markets by streamlining discovery processes and price transparency.

Insurance products and their delivery were and are, in the main, managed by primary insurers, either multinational companies like Axa and Allianz through their country operations or many, many individual local players. Insurers and many insurtechs also sell direct-to-consumer (D2C), avoiding broker commissions, but incurring huge sales costs.

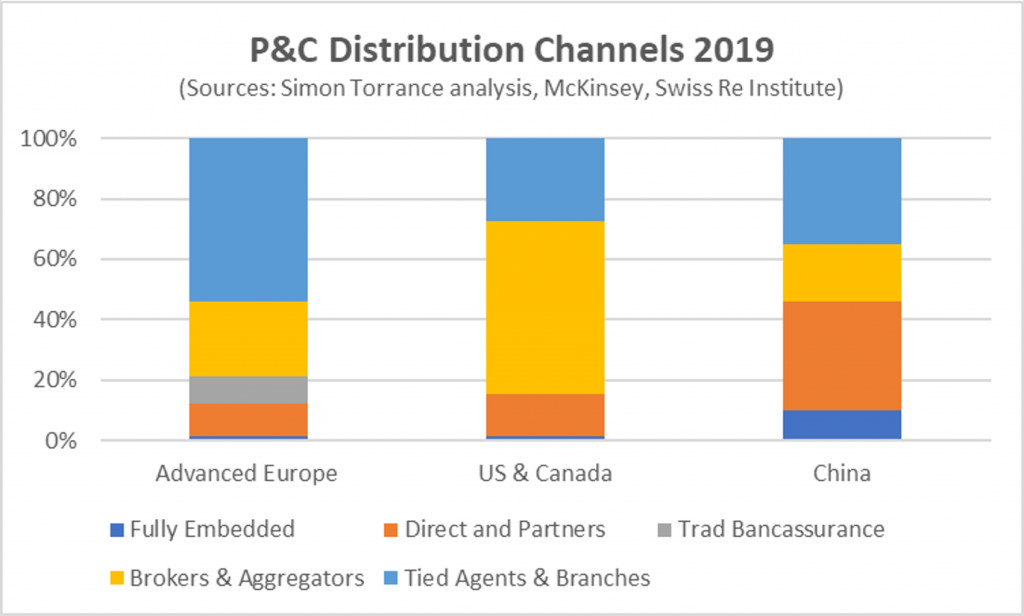

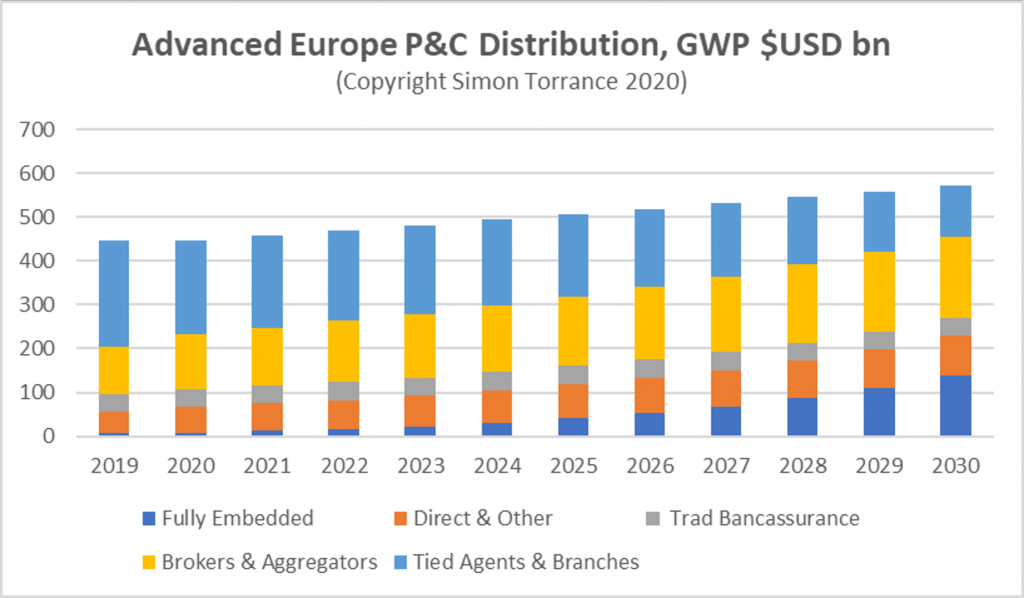

The distribution of P&C insurance today, for example, is summarised in the diagram below. While there are quite wide variations within these regions and between individual P&C product types, you’ll see that, overall, fully embedded insurance (as we’re defining it in this report) is very small today, about 2% worldwide today and even less in life and health. (More details in the market sizing section below).

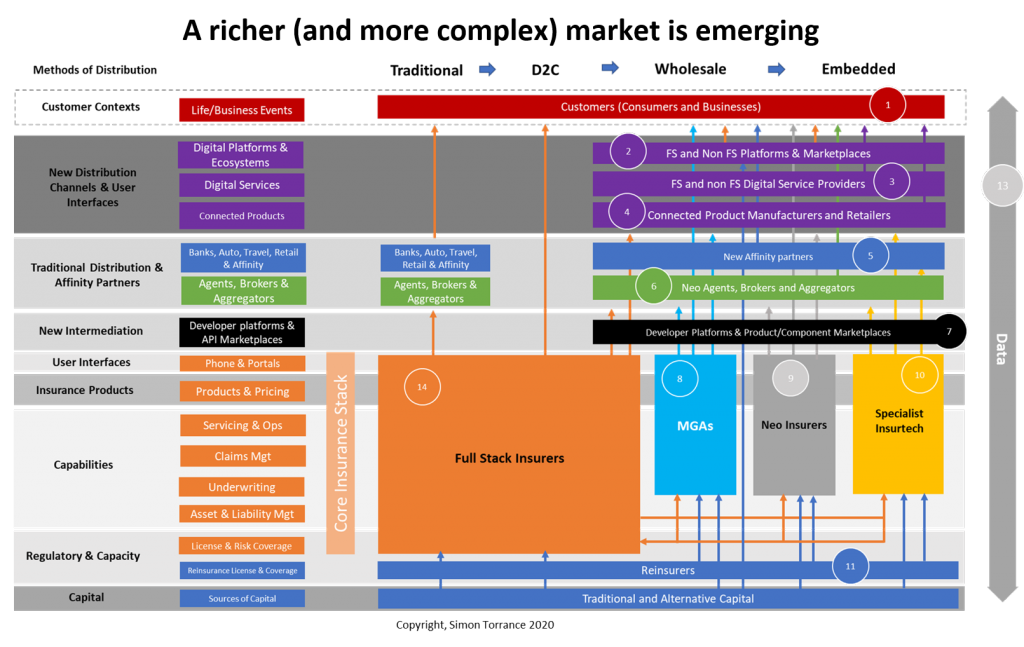

Below is a framework for understanding and exploring the changes coming to insurance distribution. It’s deliberately simplified, omitting many of the nuances and complexities that exist by product line and geography. But we can use it to discuss what’s happening for each of the major constituents, who are numbered on the diagram, and then extrapolate from there how money might flow differently over the next five to ten years.

1. Customers – individuals and businesses – are, as we’ve discussed, generally underserved by the insurance industry today as global trends relating to demographics, digitisation, urbanisation and climate change intensify the disruption to traditional ways of living, at rates never before seen in human history. The insurance protection gap is getting larger and we need new ways of thinking about it if we, our children and grandchildren are to live comfortably on this planet. Customers have the closest relationships with organisations they interact with regularly or at important moments in their lives, and these are rarely insurance companies.

2. As digitisation blurs the boundaries between traditional market sectors new digital ecosystems, orchestrated by powerful platform businesses, are emerging. McKinsey estimate that 30% of global economic activity – $60 trillion – will be mediated within these new ecosystems by 2025. Amazon, Google, Facebook, Alibaba, Tencent are just the early pioneers. Platform businesses are emerging in every conceivable walk of life, business-to-business (B2B) as well as business-to-consumer (B2C). They win when they efficiently match supply with demand, enable new levels of innovation within a market and solve intractable problems for customers. At scale they generate huge datasets and insights in real time about the activities and interests of their users, creating ideal markets for embedding insurance.

Amazon Pay, for example, recently announced it was selling auto insurance in India, promising a two-minute sign-up process and no paperwork. “This, coupled with services like hassle-free claims with zero paperwork, one-hour pick-up, three-day assured claim servicing and one year repair warranty in select cities, as well as an option for instant cash settlements for low value claims, making it beneficial for customers,” said a spokesperson.

PingAn is by far the leading exponent of the platform business model today amongst insurers. It has established a portfolio of its own platform ventures in adjacent sectors like telemedicine, automotive sales and real estate. These have attracted huge new user bases and created ideal environments in which to embed its financial services products. They have become dominant channels now for originating and maintaining customer relationships, driving 40% of new sales. PingAn plays prominent roles in nearly every part of the diagram above, creating spin off wealth management platforms like Lufax (valued at $36 billion), wildly inventive neo insurers like ZhongAn (valued at $7 billion) and technology infrastructure platforms like OneConnect which is used by 1,400 other financial institutions (valued at $8 billion with a 17x valuation multiple). It invests 1% of its revenue each year in technology R&D and is one of the world’s biggest patent holders in AI and blockchain.

During the COVID crisis, PingAn persuaded the Chinese government to allow social insurance to be embedded into its Good Doctor platform. It has discovered that 34% of all medical consultations could be done remotely, online, without sacrificing quality. This has led to the establishment of 400 officially sanctioned “internet hospitals” in China, creating a big new market for other embedded finance and insurance solutions.

3. Coronavirus has accelerated the move to digital services for organisations in all sectors, and increased the attractiveness of end-user fintechs and insurtech apps. Companies that deliver new value with compelling user experiences are winning market share across all sectors. Customers spend more time with them and, like the platform businesses which many of them aspire to become, they provide an ideal new channel for insurance products. Start-up insurtech app Thimble, for example, offers on-demand insurance to micro-businesses. 75% of its customers have never taken out business insurance before.

4. Physical products, machines and, in the not-so-distant future, human bodies are becoming more connected and smart, generating new levels of data that, combined with AI, can support, for example, the wider adoption of parametric insurance (claims paid out instantly based on pre-set parameters).

Those who make the physical products are looking to embed more added value ancillary services. For example, at a Tesla earnings call earlier this year Elon Musk said: “We’re building a great, major insurance company. If you’re interested in building a revolutionary insurance company, please join Tesla. Especially if you want to change things. This is the place to be. We want revolutionary actuaries.” He said that insurance could deliver 30-40% of Tesla’s total value in the future.

Not every company wants to create its own insurance company, but in the future many more companies, like Ant Group, will be able to design insurance products that are tailored to the needs of their suppliers as well as their consumers.

As Elon Musk said: “Insurance is a good example of a product that’s made by our internal applications team. We make the insurance product and connect it to the car, look at the data, calculate the risk. This is all [done] internally — basically [it’s an] internal software application.”

As more machines, especially industrial machines, get connected to the internet and are made smart, the opportunity to automatically embed protection into their daily operations becomes very interesting (see Reinsurers below).

5. Large banks, auto manufacturers, retailers, professional associations, travel companies have long been distribution partners for insurers. While they have been big enough to absorb lengthy contract negotiations and technical integrations, they too are coming under increased pressure to be more responsive to their customer’ needs in terms of personalisation and price. The margins that certain retailers achieve on reselling extended warrantees for electronic goods, for example, have not always been transparent and reasonable.

Other affinity partner organisations have not taken full advantage of the data they hold on their customers and simply re-sold standardised, inflexible insurance products. New technology and new intermediaries, like specialist digital MGAs, Insurance-as-a-Service and developer platforms are now enabling more organisations across more sectors to provide protection services.

John Lewis, one of the UK’s best loved retail brands, is re-vamping its financial services offerings. Working with reinsurer MunichRe and its network of fintech partners, it is looking to create more innovation solutions for its customers. This is part of a new five year strategy to generate 40% of profits from non-retail services. Ikea has launched new digital home insurance services in Europe and South East Asia.

6. Some traditional insurance intermediaries like brokers and agents are also upping their game, to interact with customers in more effective and digital ways. Too often they have been complacent, being happiest selling standardised products at fixed rates, of often dubious value, face to face or on the phone. Still, today only 20% of brokers in the US, Canada and the UK have even a mobile app or self-service portal. Millennials, now making up the majority of personal insurance consumers, are looking elsewhere.

Online aggregators (such as price comparison websites) have become particularly powerful in advanced insurance markets like the UK by making it much easier for customers to compare prices and find better deals. But recent probes by regulators have exposed sharp practices that are not in the interests of either customers or insurers. Powerful marketplace mechanisms will increasingly be embedded into the digital platforms where customers’ interest in insurance is greatest.

But rather than standard protection products being traded we are likely to see capabilities, components and product types from multiple suppliers being traded to third parties who re-configure them, like lego, in creative ways.

7. New developer platforms will enable this. We are already seeing this in the banking sector, with more and more Bank-as-a-Service (BaaS) platforms emerging that allow fintech and enterprise developers to rapidly configure banking components to create new customer propositions. Some of these have been created by fintechs – companies like Gallileo, Marqeta, Bankable, Railsbank and a growing number of smaller players – and some by incumbent financial institutions themselves, e.g. BBVA with its Open Platform, Goldman Sachs’ API platform for enterprise banking services, and Visa and Mastercard through various recent acquisitions. It used to take months or years to design, test and launch a new financial service. Now it can be done in a matter of weeks, days or hours, increasingly without the need for sophisticated coding skills.

Developers are a new and important user segment for insurance product providers too.

Insurance is further behind payments and banking in maturity, with fewer APIs and developer platforms available today. Real-time data processing capabilities in the back office are also missing. Embedded Insurance is about high volumes and low pricing so it is critical that claims processes are automated end-to-end claims and become increasingly parametric.

Certua, Kasko and Penni.io in Europe, Riskovry in India, Cover Genius from Australia, and Boost and AP Intego in the US (which distributes specialist small business insurance through Gusto, Square, Toast, Intuit and others) are examples of pioneering start-ups creating developer platforms in this space, coming at different parts of the market in different ways.

We are already seeing some developer platforms that can support multiple types of financial service, including insurance. The workflows for credit and insurance, for example, are similar. Shopify already makes 50% of its revenues from payments and loans to its B2B customers. It is in an ideal position to offer insurance too, and we might expect Stripe to facilitate this in the not-too-distant future.

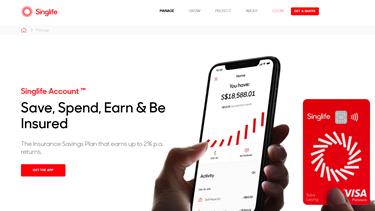

It can work the other way too. Insurers can also benefit from embedding other financial services into their offerings. For example, SingLife recently worked with Railsbank to offer a combined savings, spending, investment and insurance plan with a Visa debit card and no withdrawal restrictions, to create a closer, daily relationship with its customers and gather more data on their habits. In the past this would have been complicated, costly and time consuming to launch such a service. SingLife managed to launch its new product within a few months.

Even if automotive claims can be processed quickly today with camera phones, disbursements are often made by cheque (costing insurers $10 each time!). Insurers can now use real time payments from BaaS platforms to improve this poor experience.

A key question is: who will create the new “operating systems” for embedded insurance?

8. A new breed of MGA is emerging to fill the gaps between the needs of digital platforms like Uber, a long tail of underserved merchants and brands, as well and the primary insurers who want to reach them. Unlike brokers MGAs manage claims, borrow underwriting authority from “fronting insurers”, and offload risk to primary insurers and/or reinsurers. They bring technical efficiency to underwriting, customer acquisition, claims processing and policy retention. Brokers are increasingly interested in this model and some are setting up their own MGAs attracted by their margins and ability and control over sales processes.

Certain specialist MGA’s sell capability to merchants and brands who want to embed the types of insurance into their propositions that traditional brokers won’t touch. They source and/or design very specific products for their customers’ customers and then provide a digital platform to operate the services – potentially enabling any distributor to underwrite, bind and manage insurance policies. They are often constrained by the number of primary insurers they can work with, so are not as open as developer platforms. Specialist digitally-native MGAs tend to be startups, run by entrepreneurs. Examples include Trov, Slice and Oyster from the US, or Qover, bSurance and Inshur in Europe. Today these types of companies make up only 1% of total insurtech investment.

9. In the context of embedded insurance we contrast traditional specialist MGAs with neo insurers. The latter are the equivalents of neo banks; start-ups like Lemonade, Root, Ladder or Next that have dramatically improved the end customer experience of buying and engaging with insurance, use modern technology (cloud, modular architectures, AI) to dramatically reduce their operational costs and APIs to easily connect with third parties. Primarily they sell directly to customers and, as a result, have very high customer acquisition costs. Many offer white-label versions to other companies, which may in the near future evolve into fully-fledged embedded offerings.

10. In our taxonomy we distinguish neo insurers from specialist insurtechs who we define as those focused on selling specific enabling capabilities into the insurance industry today. In the context of embedded insurance, they may increasingly look to other sectors too as the market develops.

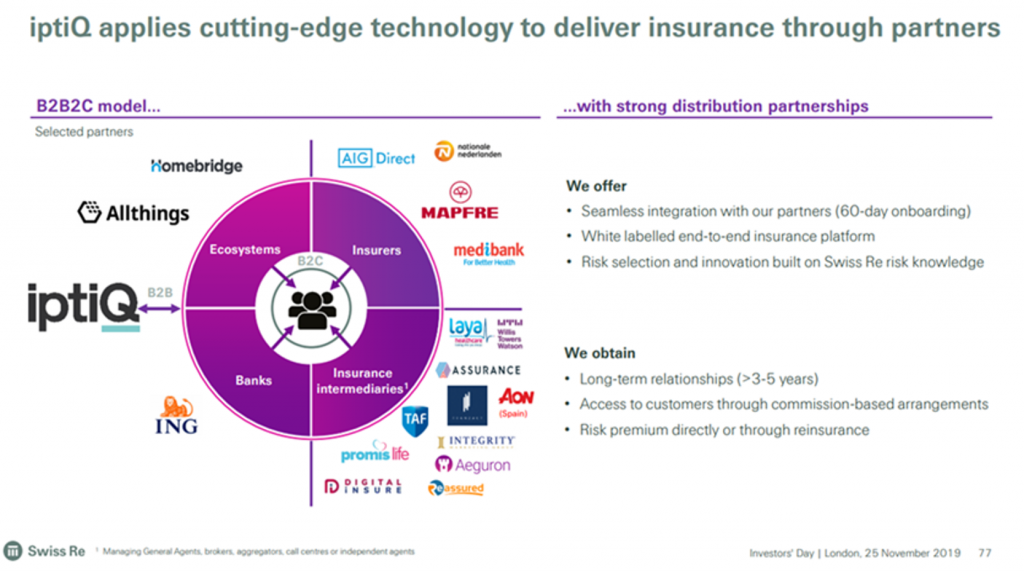

From an incumbent’s point of view, Swiss Re’s iptiQ venture exemplifies this trend. Established in 2016 as a digital venture focused on traditional insurance distributors it now targets multiple types.

Source: Swiss Re

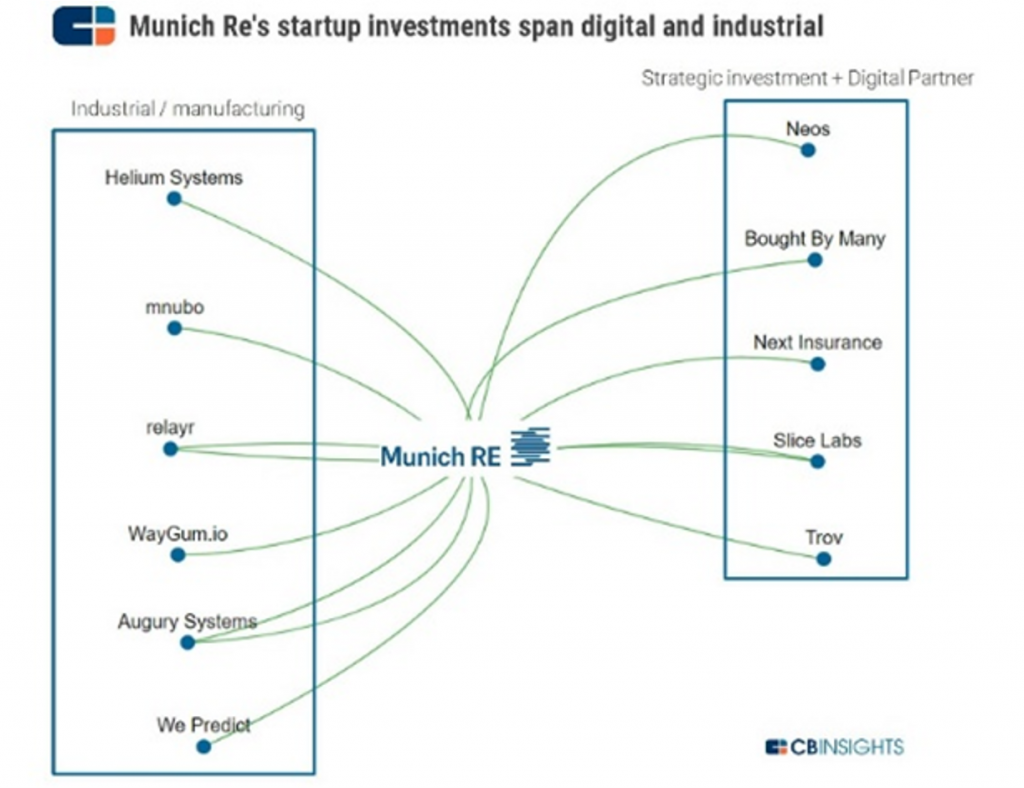

11. Reinsurers are under price pressure from increasing volumes of alternative capital entering the insurance market: hedge funds, sovereign wealth funds, pensions and mutual funds looking for new low-risk investment yields as interest rates stick at zero. As part of their response reinsurers are moving up the stack in search of new revenue streams (e.g. iptiQ) and to get closer to the risk. Most large venture capital (VC) arms, looking increasingly to partner with insurtechs to take combined reinsurers today also own primary insurance businesses and are making more investments via their corporate propositions to market, disintermediating primary insurers (per the John Lewis example above). Swiss Re recently announced a JV with Daimler to create an auto insurance MGA called Movinx.

What’s particularly interesting is a focus on Internet of Things (IoT) technology, as well as insurtech. Embedding protection into industrial systems and everyday products is a big market opportunity and a key enabler for many new business models.

Source: CB Insights

12. What would happen if alternative capital could directly support the insurance activities of digital platforms, enabled by developer platforms, specialist agencies or MGAs? Risk data, for example, could be collected by Mobility-as-a-Service platform in real-time from multiple sources (sensors, personal information, smart city data and bank accounts) and put on a blockchain. Capital providers, insurers and reinsurers could bid to cover different risk types to creating a more fluid supply of cost effective and customised protection. The mobility platform could then take on more risk to offer a wider set of services, increasing its value to more users and partners. By extending this scenario to smallhold farming or healthcare networks in emerging markets we can start to envisage new ways in which the protection gap could be addressed.

13. Data is the key to enabling all the scenarios we’ve discussed here. Accessing new sources of data, combining them, making sense of them and embedding them into new solutions will be key. One of the richest sources is bank account data, increasingly exploitable due to the move towards open banking around the world. To avoid monopolies forming, regulators across more and more sectors are looking to enable data to become more “portable and mobile” – i.e. allowing them to move between different consumer domains in fair, transparent and controllable ways that stimulate innovation and consumer value. Combining AI with alternative data sources and more advanced predictive models not only enables better insurance pricing, it also releases human underwriters to collaborate more closely with distribution partners on product innovation.

14. For incumbent primary insurers, the commercial opportunities from embedded insurance (and embedded finance) are significant: high margin access to new addressable market segments that were too risky or not commercially viable in the past. Since Embedded Insurance leverages technology and data in new ways, it can act as a catalyst for wider digital transformation and cost efficiencies.

The problem is that few incumbents today are good at execution, finding it hard to break out of old analogue ways of doing things or to attract, manage and retain top tech talent.

If a leader only has a few years to go before they retire, why rock the boat by investing in the future and impacting short term gains?

Wakam, a small 190 year old Paris-based P&C insurer, demonstrates that profitable change is possible with bold leadership. Six years ago it decided to create a 100% digital offering. Despite its size it now has 240 insurtech partnerships across Europe – supporting those that traditional insurers wouldn’t touch. With all its P&C products provided by APIs today, it now receives over ten million API calls per month and hosts 300,000 policies in its private blockchain helping to automate policy and claims management. Its new self-serve platform (“Insurance Product as a Service”) allows partners in niche sectors to determine parameters for themselves and develop products in hours. It has grown 37% CAGR since the new strategy, generating an RoE of 25% in 2019.

Wakam is interesting too in offering Licence-as-a-Service to its partners which is a significant opportunity for other primary insurers. We’ve seen something similar in the US with small, local sponsor banks very profitably supporting fintechs with embedded banking. Regulatory compliance is a critical enabler of Embedded Insurance.

Baloise is another example of a very profitable mid-sized European P&C player which has made bold moves in embedded insurance. Emulating PingAn’s ecosystem strategy, it has created a portfolio of non-insurance digital platform ventures related to mobility and the home and invested heavily in APIs.

Clearly, for incumbents, traditional channel partners are very important and need to be kept happy and supported effectively.

But, with economic profit and future growth in short supply for the vast majority of the industry, taking the time to properly investigate this space becomes an urgent imperative.

In the conclusion of this article I outline a five key options that incumbent leaders should consider and five key actions for parties interested in this topic. But first let’s first look at some forecasts of market potential.

Market sizing – $700 billion in P&C alone

To illustrate the potential of embedded insurance I have focused on the global P&C market, partly because it will be the fastest to adopt embedded insurance and partly because it’s easier (although not easy) to model.

Personal and commercial P&C lines combined represented just under $1.7 trillion of gross written premiums (GWP) in 2019, roughly a third of the overall insurance market which was above $5 trillion.

The market was growing pre-COVID at just under 5% per annum, on average, and is set to recover its growth in 2021 (albeit fastest in emerging markets). Western markets currently represent about 80% of premiums, highlighting the magnitude of the protection gap in emerging markets.

For the sake of simplicity again I have assumed no additional growth on top of current industry forecasts for the P&C market over the next ten years – i.e. volumes will go up, but prices might come down, and we are unlikely to be making meaningful dents in the protection gap until the decades after 2030.

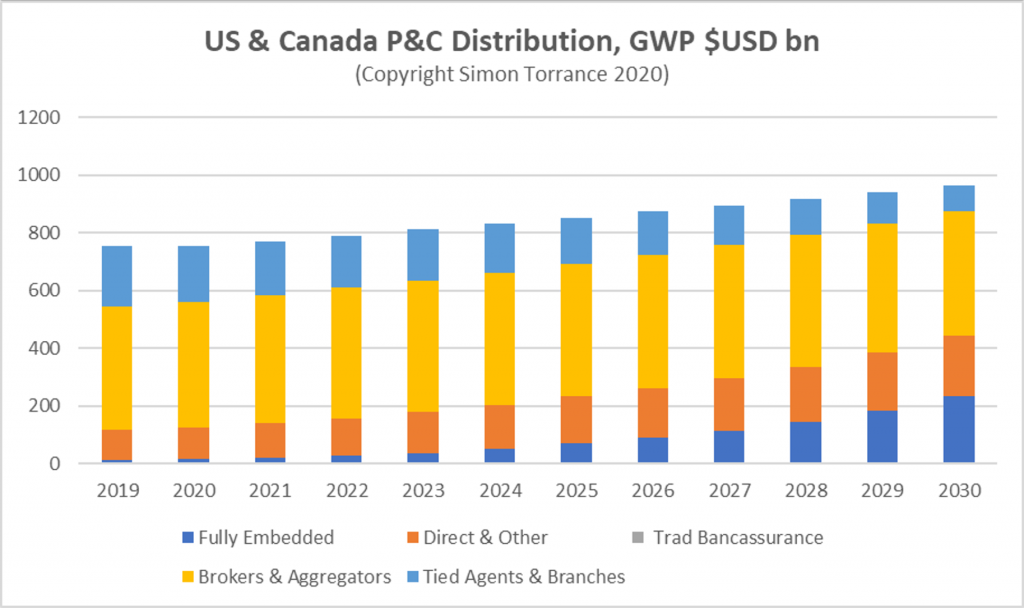

Some other things to note: P&C insurance is a very local business, even within individual countries. It is highly fragmented, with 2,500 P&C insurers in the US alone of which. The top ten companies control only about 40% of the market. There are different types of distribution for different types of products, but in general sales in most countries today are still dominated by face to face and phone interactions.

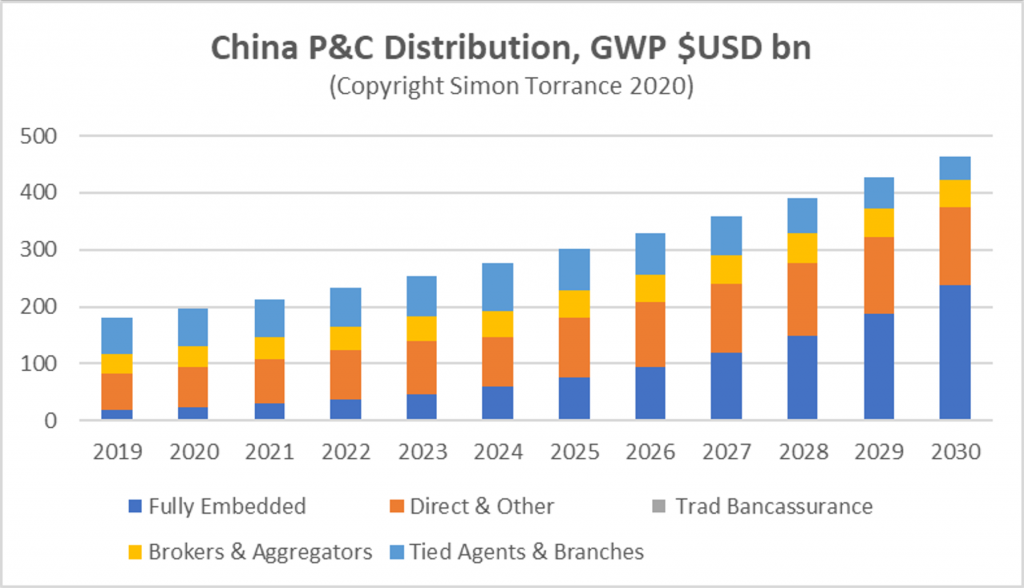

For the purposes of simplicity for this article I’ve focused on three geographies: advanced Europe, US and Canada, and China. To aid comparison, I’ve used a common categorisation for the main distribution types. For Europe in particular, I’ve averaged out the differences between countries for channel preferences. For example, while Italy is quite different from the UK today the direction of travel is, I believe, similar enough to justify merging them into one pot.

I’ve used the OECD, McKinsey and SwissRe Institute as my main sources for base information, trends and categorisation, and tested my assumptions with industry experts and insurtech leaders working in this space. For each territory I show the total market in GWP.

The categories cover the main methods by which products or solutions are sold, now and in the future, and are described in more detail below.

I’ve assumed that traditional distribution channels are digitising, but at different speeds and with differing levels of commercial impact.

So, this is how it could play out in advanced European markets, with “fully embedded” channels climbing from less than 2% of the market today to over 24% in 2030, or $140 billion.

For the purposes of this market sizing I’ve defined the channels as follows. Fully embedded builds on the definition I gave at the start of this article with these additional criteria:

- Products and solutions have been specially designed for and are (to some degree) configurable by the third party without the need for advanced software, data science or insurance expertise.

- Products are automatically integrated via APIs into a third party digital experience, as invisible native components or visible complementary add-ons.

- End customer onboarding is via a few clicks, with no physical documentation involved.

- Products leverage unique data from the third party and (in the future) other sources.

- Payments are disbursed to all relevant parties automatically and digitally.

- Products can be rapidly launched, tested and iterated by the third party, based on customer response or new market needs.

Please note that these criteria are in very early stages of maturity today in terms of levels of configurability, automation, number of clicks, unique data, or rapidity. There are still plenty of manual workarounds, but the principles help us contrast fully embedded insurance with other forms of distribution.

As we have discussed, any type of company has the potential to enable fully embedded distribution: fintechs, insurtechs, specialist MGAs, primary insurers, agencies, reinsurers, developer platforms, digital brokers, assuming regulatory compliance is in place. Today, it’s almost exclusively insurtechs, specialist MGAs and agencies.

Tied agents and branches represent the sales forces of individual insurance companies whether directly salaried or not. This is the biggest channel in Europe for P&C today, but expected to decline relative to others.

Brokers are independent insurance distributors. They distribute products from a range of insurers on a commission basis. Revenues generated by traditional MGAs are included in this category. Aggregators are typically price comparison websites or marketplaces that represent many customers and suppliers. This is a very strong channel in US and Canada P&C today and may retain its position depending on the actions of the main players.

Traditional bancassurance here means distribution through bank branches and traditional bank relationships. This is a relatively small channel in all geographies for P&C, although a very large channel for life insurance in Europe and Asia.

Direct & other refers to the distribution of products by insurers by telephone, mail or portals, or through traditional retailers, professional bodies, car dealers and other affinity partners in ways that don’t fit the fully embedded criteria. Revenue generated by neo insurers from direct to customer sales would fit into this category too. This is a very large channel in China today, primarily due to the scale of call centre operations and the growth of pure digital insurers and partnerships with third party digital platforms such as WeChat, Alibaba and others.

US and Canada is growing from and to similar levels as advanced Europe, but is a bigger market, making the total GWP distributed through fully embedded channels $234 billion by 2030.

In China, a market growing faster than Europe and America, it’s possible that fully embedded reaches just above 50% of the total market in 2030 distributing $237 billion of GWP.

Pulling out embedded insurance and adding an estimate for the rest of the world (RoW) we get to a market size of more than $722 billion of P&C insurance in GWP by 2030.

Since this is, in principle, a tech-centric distribution channel, based on current valuation multiples of leading insurtechs of five to seven times GWP today, businesses that enable embedded insurance could be worth $3-5 trillion in ten years’ time.

To put this in perspective, these businesses would be more valuable than the top 30 financial institutions today, and this is P&C alone.

Technology will develop very rapidly during this period, regulation may be a hindrance or a help and investor appetites may change.

So, even if we are ten times too bullish it’s still a big enough market for all kinds of players to pay attention to.

Conclusion – options and actions

Insurance incumbents have many options about where they play and how to win in this market. For example, they can do one or more of the following:

- Create flexible products that can be more easily sold through embedded channels.

- Create developer platforms through which their own and third party products and tools can be distributed.

- Create non-insurance digital services, platforms and ecosystems which create closer relationships with end users and new demand for insurance solutions.

- Create software products and tools that help third parties and internal teams exploit embedded insurance.

- Acquire companies in any of the areas above.

- Drive industry standards for APIs, identity management, passporting, regulatory compliance, data access and usage, in a way that catalyses (and controls) the direction of innovation in this space.

In terms of how to win, all players in the market will need to consider whether to build things internally, collaborate with others or create completely new ventures. There are pros and cons of each, depending on levels of ambition and capabilities.

Taking a portfolio approach and making bold moves works best. Doing nothing, or doing things half-heartedly, are not good options.

Ultimately, embedded insurance provides an opportunity to re-think traditional industry business models and sources of value by leveraging the full power of software and connectedness.

For all interested parties – entrepreneurs, big tech, fintech, VCs, PEs, reinsurers, MGAs, brokers, agents and even retailers, software companies, manufacturers, telcos, energy companies and any other organisation with a large user base – I recommend five next step actions:

- Understand: the mechanics, the economics and the assumptions of embedded insurance (and Finance)

- Identify: the opportunity spaces that are most relevant to you.

- Assess: the best ways to execute, in terms of a portfolio of methods including internal ventures, partnerships, M&A and external ventures.

- Organise: ensure you have the right organisational set up and incentives to manage your portfolio effectively.

- Act: now, testing and iterating on all fronts as you move forward.

Final thought:

“We overestimate the impact of technology in the short-term and underestimate the effect in the long run.”

Bill Gates, after Ray Amara

About the author

Simon Torrance works with leaders, executive teams and boards to create and implement new growth strategies and ventures based around the new disciplines of platform strategy, digital ecosystem management and corporate venture building.

Simon Torrance works with leaders, executive teams and boards to create and implement new growth strategies and ventures based around the new disciplines of platform strategy, digital ecosystem management and corporate venture building.

Visit Simon’s website, connect with him on LinkedIn or email him directly at [email protected].