How brands are becoming the banks of tomorrow

Traditional banks are having a tough time. Years of low interest rates have squeezed margins to a sliver and Basel IV has dampened their maneuverability – or so they say. But what if external factors are not the key driver in their decline. What if, in fact, their centuries-old business model needs to be redesigned? What if the next account you open or the next loan you take out won’t come from your bank, but your favorite e-commerce shop? And what if I told you, that this has already been going on for some years, with the really big wave still ahead of us?

To understand what the bank of tomorrow looks like, we must first understand how they developed.

To understand what the bank of tomorrow looks like, we must first understand how they developed. Over the last 30 years, banking has undergone three stages.

The branch: drowning in paperwork

This was banking in its original form, with bank tellers and advisers at a local branch. While this entailed the pleasantries of interpersonal interaction, it wasn’t exactly convenient. Heaps of paperwork for the simplest of transactions; zero insights into your balance or spending behavior; appointments; waiting lines. Still, the demand was there. Everyone needs banking services in their daily lives. But the options were limited. The barriers to entry into the highly regulated banking market prevented any serious competition. So, the banks focused more on dictating the customer journey according to their terms than on innovating their processes; and this is by no means a picture of the past. Many incumbent banks still rely on analogue processes today and struggle with dismantling their self-absorbed mindset.

The challengers: convenience as the new paradigm

With the onset of digitalisation and the mass adoption of smartphones this changed dramatically. The first tech-savvy mobile banks that enabled on-the-go transactions and spending insights on demand, such as ING, set the precedent for a wave of challenger banks that put the customer at the center of everything they do. New mobile-first players like Revolut, Monzo and N26 emerged on the basis of good design and an intuitive user experience, suddenly making banking convenient and engaging for millions of users.

By doing away with branches entirely and relying on cloud-based tech stacks, these challengers had much lower customer acquisition costs than their incumbent grandparents, resulting in some of Europe’s most illustrious growth stories. This banking renaissance sparked the emergence of further neobanks that target specific niches and built value-added ecosystems around the digital account. Prominent examples are small and medium-sized enterprise (SME) banking specialists such as Penta, crypto banking pioneers like Bitwala or sustainable banking players like Tomorrow.

But it wasn’t just technological advances that caused this shift in market share. With the advent of open banking, enabled by the Second Payment Services Directive (PSD2), new fintechs such as Finanzguru, Trustly and Numbrs were popping up everywhere. They are able to retrieve account information and initiate payments straight from their users’ bank accounts, and treated the bank account as a commodity to be enriched with further features.

- Contextual banking: financial services seamlessly synced with life

Contextual banking, also often referred to as embedded finance, takes the concept of open banking one step further. The idea behind contextual banking is to embed financial services directly into the products of other providers. This way, the financial service is available precisely at the time and place it’s needed.

The oldest example of this in the German market dates all the way back to 1926. That was the year the Ford Credit Company was founded in Berlin by Henry Ford, Germany’s very first bank that was owned and operated by a car manufacturer. Back then, automobiles were unaffordable for the majority of German consumers, and traditional banks were unwilling to finance them. So, Ford enhanced their core proposition – selling cars – with lending services, allowing them to address a much larger market and extend their customer relationship by multiple years.

Fast forward to today, and the GAFAs are leading the way

Next to the usual suspects of Amazon, Apple and others, Big Tech ecosystems like Uber or Shopify are pioneering the trend of contextual banking. They have recognised that by enriching their products with financial services such as bank accounts, payment cards and lending services, they are able to benefit from higher customer stickiness, more touchpoints and additional revenue streams. Further, if these players can augment the wealth of user data they already possess with data on spending behavior, they can offer their customers tailored financial solutions at a quality that is indistinguishable from that of a personal financial advisor; with significantly lower underwriting costs.

However, these benefits are not limited to Big Techs. Any player with a loyal brand following can strengthen their ecosystem by incorporating financial services into their offering. Take big mobility brands such as Lufthansa, global retailers like IKEA, or even sports clubs like Manchester United. Their customers have accompanied their brands for decades, and often have strong emotional ties to the brand. They enjoy at least the same levels of trust from their customers that were previously unique to banks. And trust is the key to banking. What if players like IKEA and Lufthansa were to offer a fully-fledged bank account with features like cashback and installment payments on big purchases? This could open up entirely new avenues to engage with customers and improve their user experience.

This is more than just a “nice-to-have”. It’s a massive opportunity.

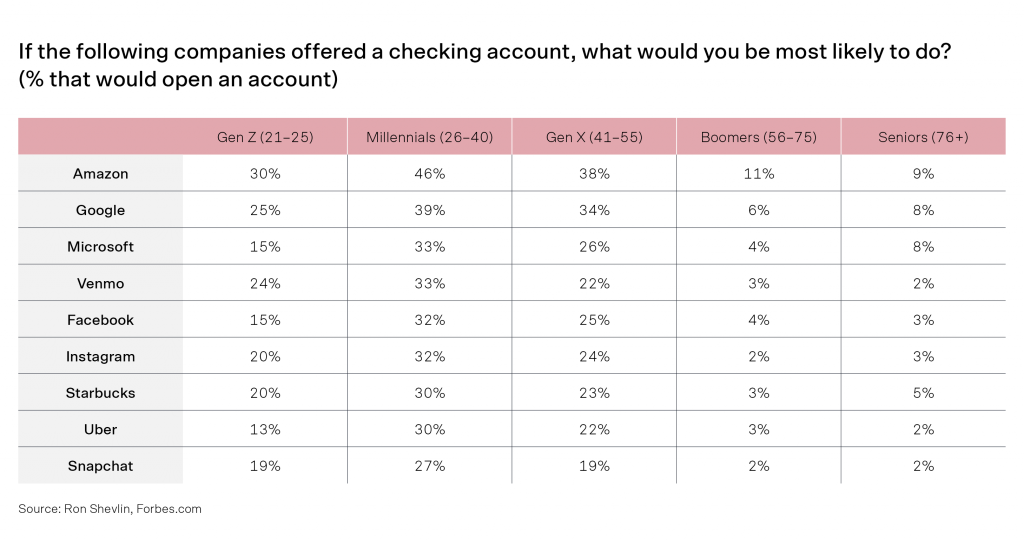

Bain Capital Ventures estimates that there is a total addressable market of $3.6 trillion of value to be generated from contextual banking over the next ten years – and that’s just the US. At the moment, incumbent banks still enjoy the trust of their customers. But as consumers like you and me become conditioned by the comfort of on-demand, customer-centric services provided by the likes of Google, Amazon et.al, our expectations towards financial services will adapt. A study by Cornerstone Advisors found that a significant proportion of consumers below the age of 55 would already today be happy to open a checking account with a non-bank brand.

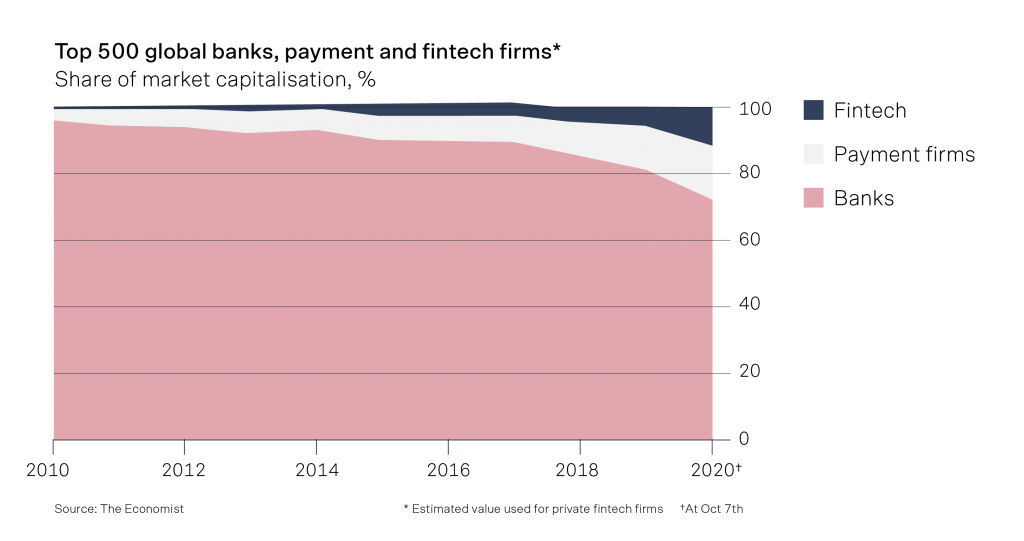

In Germany alone, there are over 100 million checking accounts. I expect that in as little as five years from today, 50% of financial services in Germany will be provided by non-bank brands and challenger banks. That would be more than 50 million accounts up for grabs. This figure multiplies as you look beyond Germany across the European landscape. Banks have already been losing market capitalisation share at a steady rate over the past ten years, as innovative fintechs and payment champions eat away at the incumbents’ core business. With more non-financial players joining the party, this trend will only accelerate.

OK, but how?

So, there are obvious benefits to reap for brands by embedding financial services into their products. What is less obvious however, is how this can be achieved. After all, banking remains one of the most highly regulated industries anywhere in the world, and rightly so. Players willing to break into the financial services sector face two choices:

- Become a bank themselves

What may sound straightforward at first, is in fact a very complex and resource-intensive endeavor. There are several hurdles to overcome to found and operate a bank at scale. In Germany, businesses offering banking services such as deposits, loans and payment services are subject to licensing requirements; anti-money laundering regulation; capital requirements; regular audits; as well as reporting duties to the central bank and supervisory authority. The overhead alone to sponsor these requirements can nip the project in the bud.

However, that is just one side of the coin. Banking, at the end of the day, has become a tech game. To embed a competitive banking offering into your product, your technological infrastructure has to be scalable and digitally integrated with your core business. Building up and maintaining a payment ledger that is both resilient and compliant requires significant levels of investment and in-house knowledge.

Aside from deterring market entry tremendously, the licensing requirements and operating costs required to run a bank significantly dampen the likelihood of the project turning a profit.

- Partner with a licensed bank

This option would allow you to circumvent the regulatory overhead, but not necessarily the technological overhead. The landscape of licensed banks that have the technical capability to integrate with another party’s product is dire. Even if an incumbent could offer an interface for other players to connect to its banking infrastructure, that infrastructure is relying on legacy tech that is not built for purpose, and is therefore unlikely to offer the flexibility, breadth in features or pricing needed to build a competitive proposition.

Further, banks are not necessarily keen on enabling new market entrants out of fear the players they enable with their infrastructure cannibalise their market share. They may thus not be incentivised to offer white-label solutions, but rather force their own user interfaces into the customer journey. The prospects of partnering with an incumbent bank are thus rather bleak, likely resulting in either a sub-par user experience and unattractive timeline.

This is where specialised Banking-as-a-Service (BaaS) platforms come into play.

These API-based providers enable their non-bank partners to pick and choose the individual banking components they need, such as checking accounts or lending services, and directly integrate them into their website or application. The BaaS provider conducts all of the regulated processes in the background, including payment processing; anti-money laundering (AML) monitoring; account management; loan origination; and regulatory reporting, while the end customer relationship remains entirely with the partner. This way, brands can offer digital banking products in their own look and feel, and delegate the compliance risk, capital requirements and technical overhead to the Banking-as-a-Service provider.

This API-based approach offers a much faster and cost-effective alternative for players that want to create best-in-class financial experiences in new contexts, without risking that the banking partner cannibalises their customer base. As a fully licensed BaaS platform, Solarisbank has enabled numerous global brands to take this step, including Samsung, who is leveraging Solarisbank’s full breadth of services for their newly launched Samsung Pay offering in Germany.

It should be evident that any company that wants to invest in customer loyalty and experience needs to wrap their head around integrating financial services. The question is not if, but when, they do this. We are only at the start of the journey for contextual banking, but time is running out for big brands if they want to win first-mover advantages. Incumbent banks are also not oblivious to this threat. If they are unable to go down the route of becoming a BaaS player themselves, they will cling on to their customer base and won’t go down without putting up a fight. But no matter how banks will choose to position themselves, one thing is certain: With BaaS, any company can become a fintech company – and they should.