How Danske Bank had to change to support start-ups

This is an excerpt from the book, ‘Transactional to Transformational: How Banks Innovate’, available on Amazon.

Earlier this year, Pleo became the 8th tech start-up in Denmark to reach unicorn status. It took them just over six years to achieve that, faster than any other Danish company in history.

This illustrates why Danske Bank recognised a few years earlier the need to change how they did business to capture and support this new generation of business customers.

At the outset the bank could on the one hand see the trends that more and more start-ups were able to start from scratch and build tech companies that were able to scale to big global companies within a few years, making the segment an attractive customer group.

On the other hand, the bank also recognised that the new business models did not fit well with their traditional banking models. Unlike traditional companies that grow organically by investing their profits in growth the following year, most tech companies obviously finance their growth with venture capital from investors. This allows them to have negative results in the first few years and focus on revenue growth and market share, enabling them to grow with exceptional speed in later stages.

Bank lending to these start-ups, the main traditional product for business customers, would be a very risky business since a great deal of the start-ups would fail during their growth. Therefore, engaging with start-ups was not the preferred approach for traditional bank employees, which again also reflected the perception among start-ups and scale-ups that the bank lacked the agility and understanding to be able to cater for them.

Therefore, the overall challenge for the bank was to create a targeted value proposition, making it attractive to these fast-growing tech companies and at the same time driving a positive business case for the bank. The bank understood that there was a need to reinvent banking for this segment, which led to the forming of the Growth & Impact initiative.

“For the bank to own the big clients of the future, we need to start early, this is long-term relationship building,” explained Kent Due-Frederiksen, Global Head of Danske Bank Growth.

From the beginning, the initiative was labelled an ‘Innovation Moonshot’ at Danske Bank, thereby recognising it as an ambitious and exploratory project created without any expectation of near-term profitability. The objective was first to create value to the segment and afterwards find out how to monetise it.

In the beginning, the bank used a typical approach for business development using internal resources paired with Tier 1 management consultants. It soon became clear that the process did not give the insights and results required, and it also became apparent that the bank and advisors did not have the mindset needed to find the right solutions for the start-up and scale-up segment.

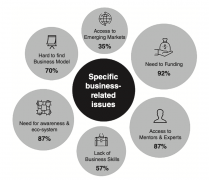

Instead, the bank turned to the venture building company Rainmaking, and together they launched a digital platform which was named The Hub. They invited start-ups to tell them what they wanted help with and evolved the platform to support that.

Source: Danske Bank, 2021

The Hub has since evolved to support the most pressing challenges, e.g., that of recruiting talent, finding funding and getting access to best practice tools. Since its launch in late 2015, The Hub has developed into the largest marketplace for start-up jobs and talent in the Nordics.

Today it includes more than 8,000 start-up profiles and 28,000 jobs have been posted since its inception, which have had more than 500,000 applicants. In addition, it has worked to create more transparency between start-ups and investors in the funding process, with more than 1,000 investor profiles.

From the very beginning, the overall vision of the initiative, and the measure of success, is to “help start-ups scale their business”. As part of its impact on society, the bank has set the ambitious target of supporting 10,000 Nordic start-ups and scale-ups with growth and impact tools, services and expertise by 2023. By the end of 2020, 4,600+ start-ups or scale-ups have been supported.

In addition to this KPI, operational targets are set annually and followed for each of the initiatives. The commercial results show in the start-up and scale-up customer portfolios of the growth advisors. The ambition is to have 20% year-on-year (YoY) growth in income from the segment, which so far has been reached, showing a substantial success for the team.

Furthermore, along the way, the bank and commercial part of Growth & Impact has been on a journey to understand how fast-growing companies operate today. New ways of assessing risk and new ways of working have been the result.

The expectations for the next five years are to institutionalise the setup and scale the operation across all Nordic markets. It will be important in the coming years to continue aligning with the rest of the bank and integrate the unit ‘back into the bank’, e.g., by exploring how to create a value proposition towards other customer groups in the bank that find it attractive to establish relations with start-ups.

For corporate customers, it will centre around collaborating with start-ups on new technologies and business models. For private banking customers, it will centre around potential investment opportunities in fast-growing companies looking for venture capital.

About the author

Christer Holloman writes for FinTech Futures about innovation and diversity within financial services and fintech.