Bank of America invests in UK paytech Banked, launches new online payment solution

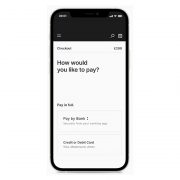

Bank of America (BofA) has launched a new online payment solution named Pay by Bank in partnership with UK paytech start-up Banked.

Pay by Bank has been launched in conjunction with Banked

Currently only available in the UK, BofA says it has plans to roll-out the e-commerce solution to other countries and regions in the near future.

BofA’s co-head of global corporate sales, head of GTS sales and head of GTS EMEA, Matthew Davies, says the launch is “part of our continual cycle of technology investment”.

Pay by Bank allows users at online checkouts to connect their mobile banking app and authenticate the purchase using biometrics with no logins required.

BofA says Pay by Bank transactions take place in real-time and require no credit or debit card details, making online checkout simpler, faster and more secure.

Banked CEO Brad Goodall says the paytech’s “maniacal focus” on infrastructure, security and end consumer experience means clients only need to focus on integration.

BofA also co-led a $20 million Series A round in Banked to support the London-based company’s US expansion plans.

The investment round was co-led with Edenred Capital Partners and also saw participation from Acrew, Force Over Mass, Firestartr, OM2, Love Ventures, Kuvi Capital and Indeed.com founder Paul Forster.

New investors included Sidekick, 9Yards and PayPal veteran Huey Lin.

Founded in 2018, Banked says it has now raised more than $30 million to date.

Goodall adds: “2022 will see some really big brands go live with Pay by Bank, driving at the heart of delivering innovation at point of purchase to both the merchant and consumer.”

Very good