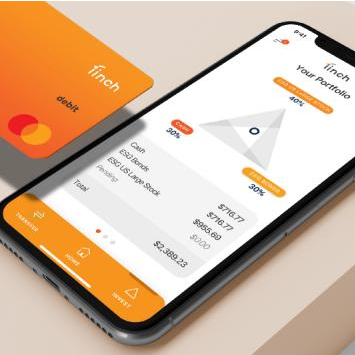

Banking challenger and investing platform Finch set to launch in US

US challenger Finch is set to launch this year, billing itself as a banking and investing platform that enables customers to earn investment returns directly on their account balance.

Cashback is automatically invested into Finch’s users’ personalised portfolios

Co-founder Maya Nijhawan says Finch is a “hyper-productive account designed to help millions of Americans make the most of their idle cash and develop healthy financial habits”.

Designed for people who don’t know how, or have the time to, see greater returns on their money, Finch recommends personalised investing portfolios that earn market returns.

These returns are reflected instantly in the user’s balance and can be spent instantly, the start-up says.

Sign-ups do not need to switch banks; instead, users link their primary current account with the app.

Customers can also earn up to 5% cash back when spending on their Mastercard-backed Finch debit card.

The cashback is automatically invested into users’ personalised portfolios. Investment pots can also be filled via a single deposit or as a recurring investment.

And to help people with poor or low credit, the fintech reports monthly spending as credit worthy payments to US credit bureaus Equifax, Experian and TransUnion.

The Finch Rewards Card also acts as a credit card, which is automatically made whole from users’ linked current accounts.

Additional benefits include no hidden fees, no account minimums, free bank transfers and no added fees for foreign transactions.

Users can also make free withdrawals at more than 55,000 ATMs across the US and Finch is backed by both a FDIC-insured bank and a SPIC-insured broker dealer.