Why is digital customer onboarding so important in banking?

New banking customers are expecting to open a new checking or savings account remotely by using their laptop or mobile device. According to the special report published by BAI three-quarters of millennials say they would switch banks for a better mobile experience, while Gen Xers’ appetite to use digital methods to open bank accounts for savings and loans is rising.

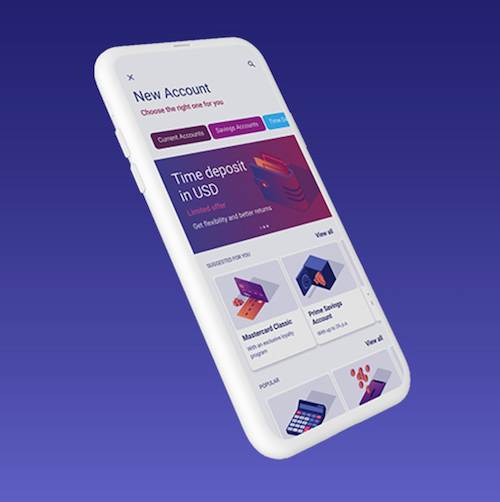

Mobility goes to the next level, and it is becoming critical to deliver a competitive onboarding process. Users need to be able to open a bank account on any device, whenever they want. However, an issue might arise because of this. Most banks will need to acquire a new level of technical flexibility. To provide bank personnel with a 360-degree customer view, data must be accessible through APIs, systems, and form fields that are easy to use.

Mobility goes to the next level, and it is becoming critical to deliver a competitive onboarding process. Users need to be able to open a bank account on any device, whenever they want. However, an issue might arise because of this. Most banks will need to acquire a new level of technical flexibility. To provide bank personnel with a 360-degree customer view, data must be accessible through APIs, systems, and form fields that are easy to use.

The various banking departments need to communicate in real time, and silos must be broken down. Due to their design, large legacy systems are frequently unable to integrate with such an ecosystem. Technical support is required to bring all the pieces together and provide a consistent onboarding experience.

Is digital onboarding delivering to the bottom line of the bank or is it an extra cost?

The digital onboarding process becomes paramount for the competitiveness of the bank when delivering the customer experience, thus increasing conversion rates. Additionally, investment in a modern onboarding process can potentially offer cost cutting, improve efficiency, and eliminate obstacles and response time whilst adhering to some of the most severe restrictions with ease.

What are the advantages of making an investment in digital onboarding?

According to the Vass corporate survey, the following are the most important benefits:

Speed: Bank onboarding is typically a high-friction process that includes trips to the office, long lines, messengers, and costly paperwork. What previously took an average of three weeks can now be completed in three minutes. Bank customers can use a digital onboarding process to register a person with all the necessary requirements and extra credentials that the bank needs to do business with them.

Ease of use omnichannel: A digital onboard can be done by anyone with an electronic device, a camera, and internet access. The process can be completed, and the customer does not need to visit the bank or fill out forms.

Efficacy in real time: Security measures are done in real time, and the biometric pattern of the face and the person’s life are also checked. All of these are processed in seconds.

Increase in customer numbers: Conversion rates have grown by 40%, as a result of improving customer experience.

Any form of identification: Both identification and registration are based on the use of biometric tools for document recognition and capture, following the legal and business requirements (ID, passport).

New customer registration model: Banking organisations are setting the foundation for their future on a technology pillar that will allow them to offer new products and services, as well as new customer relationship models.

What’s the result?

What’s the result?

To meet client requests, financial institutions engage in digital onboarding via online and mobile platforms. For the third year in a row, Forbes reported that digital account opening is the most popular banking technology.

In 2021, about 80% of all financial institutions implemented new systems for creating digital accounts or improving existing ones. On the other hand, many financial institutions are still a bit reluctant to offer a full digital service end-to end.

Parts of the onboarding process may be completed online, but the consumer must still sign the final paperwork in the branch. This step might be a crucial winning element for new clients, resulting in higher abandonment rates. Even though financial institutions offer a completely online experience, the online onboarding process is too difficult or time-consuming for people to finish, so they leave.

According to a Lightico study, 40% of millennial consumers who applied for a bank account abandoned the onboarding process. They cited a lengthy, time-consuming verification process as well as issues with filling out paperwork as grounds for abandoning the project. If banks cannot deliver a quick and straightforward mobile onboarding procedure, customers will either go to another financial service provider or give up trying to receive that service at their bank.

The regulatory framework of digital onboarding

To obtain a better picture of what to expect from the onboarding process for digital banking, let’s start with the rules indicated in a Timequantum article. It is critical to begin with a strong statement. Selfies and photographs are in violation of anti-money laundering (AML) and anti-terrorist funding standards in the banking business (know your customer/KYC and AML international legislation). It’s primarily due to a lack of technical security.

At the European level: According to the European Anti-Money Laundering Directives (AML5) and the eIDAS Act, digital onboarding video identification is permitted by the European regulatory framework. This means that, unlike in the past, consumers in the financial sector can now be digitally onboarded across Europe, which results that 500 million people are able to open an account at any financial institution in Europe.

On a worldwide scale, AML/KYC digital onboarding: More governments are regulating the practices of video identification for digital onboarding, where a key demand arises: the “bankarisation” of citizens, to avoid widespread fraud and overthrow of the competition. Other sectors are regulating this type of behaviour as well.

Certification authority: Due to the eIDAS and AML5 regulations, you can now issue “natural person” certifications remotely.

e-KYC

To increase customer acquisition, nine out of ten banks use digital onboarding technology. Onboarding processes that used to take three weeks or longer can now be performed in three minutes or less. Both employees and consumers save time, which reduces bureaucracy and reduces the risk of client loss.

The future of omnichannel onboarding

Customers can start their onboarding journey anywhere (a search result, a homepage, an Instagram post, or a link from a blog) and switch to another at any time to continue where they left off with omnichannel solutions. Successful onboarding follows the customer around between platforms, remembers the information they’ve already put in, and makes it easy for them to start again later, which lowers the chances that they’ll drop out.

It’s now or never!

It’s now or never!

Digital onboarding is a chance not to be missed. This acquisition, as well as the reduction in expenditures and attrition rates, have all been demonstrated. Banks that have taken a proactive stance have seen no repercussions. Reports state that digital onboarding increased new customer acquisitions and retention rates. While there are benefits, there is also a lot of pressure.

Young and elderly customers are accustomed to using online tools to book flights, purchase insurance, and purchase practically anything at their leisure and through their preferred channel. Challenger banks are shaking up the market by transforming onboarding and making it easier than ever before to gain customers with the help of technology. It’s also not nearly as difficult as it appears.

Finuevo Digital

Finuevo Digital has already developed the software that connects the different parts of the banking system and gives customers a consistent and satisfying experience.

By Dionysis Kritikos, Senior Product Manager, Finuevo Digital Banking Platform

References:

Vass corporate survey: Digital onboarding in financial services

Forbes: The 5 hottest technologies in banking

Lightico study: How to onboard millennials

Time Quantum article: Digital onboarding for the banking sector

About Profile Software

Founded in 1990, Profile Software is a specialised software solutions provider with offices in key financial centres and a presence in 45 countries across Europe, the Middle East, Asia, Africa and America delivering market-proven solutions to the investment management and banking industries.

Founded in 1990, Profile Software is a specialised software solutions provider with offices in key financial centres and a presence in 45 countries across Europe, the Middle East, Asia, Africa and America delivering market-proven solutions to the investment management and banking industries.

Profile Software is recognised as an established and trusted partner by international industry specific advisory firms. Profile Software’s solutions enable organisations to align their business and IT strategies, while providing the necessary business agility to proactively respond to the ever-changing market conditions.