Banking app for “global citizens” Bankkit launches in UK

New banking app for “global citizens” Bankkit has launched in the UK, offering foreign exchange and overseas bill payment functionality and an integrated current account.

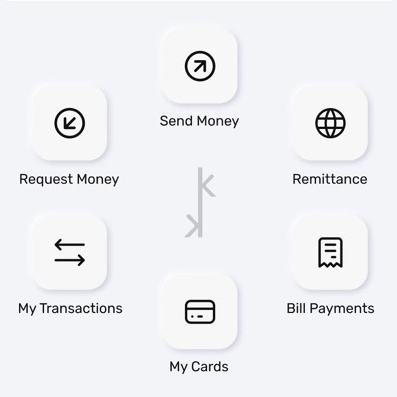

Bankkit offers a number of financial services for the “global citizen”

The start-up aims to be a “seamless multi-product” in a financial world that “goes beyond traditional global borders”.

Bankkit also claims to offer a feature “which no UK bank has” – the “easy payment” of overseas utility bills and non-utility bill payments.

Customers will have access to Bankkit accounts in 23 countries for bill payments, including Argentina, Costa Rica, Dominican Republic, Ecuador, Egypt, El Salvador, Ghana, Guatemala, Honduras, India, Indonesia, Jamaica, Jordan, Kenya, Mexico, Nepal, Nicaragua, Nigeria, Pakistan, Peru, Philippines, United Arab Emirates, and Vietnam.

The firm, which claims users can open a UK bank account “in minutes”, also offers dark web cybersecurity protection and terminal-free, instant B2B and B2C QR code-based merchant payments.

The start-up claims that without monthly terminal fees, no commission on transactions and no limit on the number of transactions, businesses could save “thousands of pounds” with the QR code-enabled Bankkit Pay.

Bankkit founder Nadim Choudary says: “Knowing how much money is transferred between countries, especially by South Asian ex-pats living in the UK, with over $83 billion transferred from the UK to India in 2020, we wanted to create a one-stop solution that combines a UK current account with a low-cost FX remittance capability.”