UBS partners iProov for automated customer biometric ID onboarding

Swiss bank UBS has partnered with iProov to automate online identity verification checks when customers open an account.

UBS partners iProov for automated ID verification onboarding

In May 2022, UBS launched UBS key4 for users who want digital access to their personal and savings accounts, and other banking services.

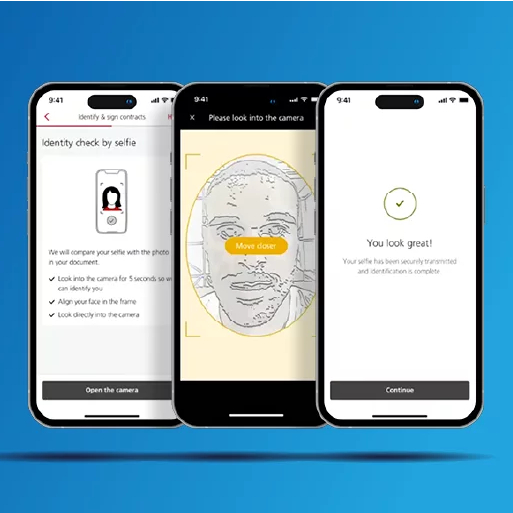

Leveraging iProov’s face verification technology, UBS key4 customers can now onboard remotely at all times of the day in five minutes, iProov says, scanning their face against a trusted government-issued document, such as a passport with an NFC chip.

iProov says the new technology deployed at UBS simplifies the user experience, broadens financial inclusivity, reassures customers, protects against fraud and complies with know your customer (KYC) checks and other regulatory requirements.

UBS is the first bank in Switzerland to offer this process for account opening in combination with qualified electronic signatures.

Prior to partnering with iProov, UBS key4 relied on using video calls to verify client identity virtually.

The regtech says its cloud-based automated ID verification technology delivers a more than 98% typical pass rate with a 1.1 average number of attempts to achieve success.

iProov’s technology is used around the world, including banks and governments such as Rabobank, ING, the US Department of Homeland Security, the UK Home Office and the Australian Taxation Office.