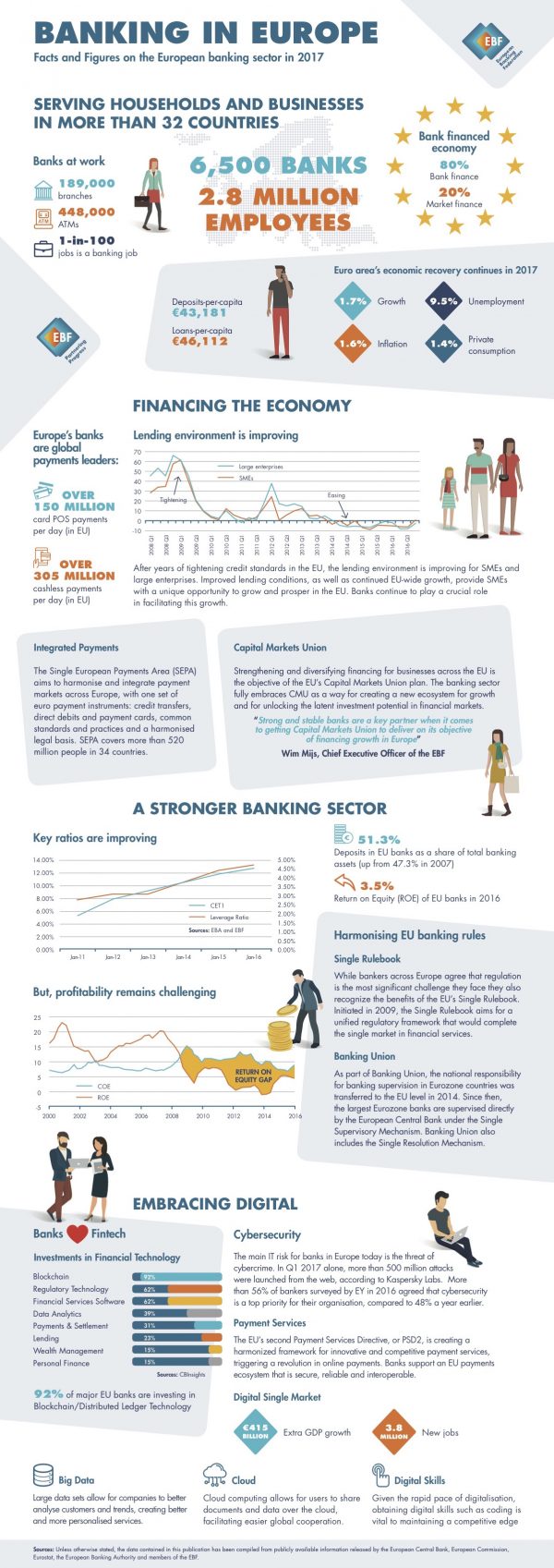

Infographic: Banking in Europe 2017

European Banking Federation (EBF) has published its annual update on the banking sector in Europe, reports Paybefore sister publication Banking Technology. Staff numbers and branches in the European banking sector continued to shrink in 2016, while Eurozone deposits and loans grew slightly, according to the EBF findings.

The number of bank branches in the EU declined to 189,270—about 9,100 branches were closed last year. By comparison, the number of branches in 2008 stood at 237,701.

The number of people working for credit institutions in the EU fell to 2.80 million last year from 2.85 million a year earlier. This compares with 3.26 million in 2008.

The number of credit institutions in the EU has consistently fallen for eight years in a row and declined last year by 453 to 6,596 banks from 8,525 in 2008. Germany is home to more than 25 percent of all banks in the EU.

The total deposits from businesses and households, as defined by non-monetary financial institutions, grew by 1.2 percent in 2016 to €15.9 trillion (US$19 trillion) in the EU at the end of 2015, with €11.8 trillion (US$14.12 trillion) in deposits in the euro area. Deposits from households rose 1.7 percent compared to a year earlier while business deposits increased 3.7 percent.

The value of loans to EU households declined 0.9 percent to €7.6 trillion (US$9.1 trillion), reflecting a drop in non-euro area values. Loans to households in the euro area however grew for a second consecutive year, adding some €200 billion (US$239.33 billion) since 2014.

More facts and figures in this infographic created by EBF: