AnaCredit – turning compliance into opportunity

The data firms need to submit to their national central banks is a great source for internal risk management and business intelligence (BI) insight. And as AnaCredit goes live in Europe, firms now have an opportunity to improve return on investment (ROI) on existing infrastructure and use such data for strategic decision-making.

Nicos Kynicos, senior regulatory reporting specialist at Wolters Kluwer’s finance, risk and reporting business, examines the opportunities.

This year is vital for the European Central Bank (ECB) AnaCredit project as it goes live for Stage 1 after seven years in the making. Although it’s interesting to observe the differing ways in which EU member states have implemented AnaCredit in terms of scope and timelines., it’s perhaps now an opportune time to provide some guidance and ideas on how firms can benefit more broadly from their “AnaCredit investment” – particularly as relates to data management and technology infrastructure.

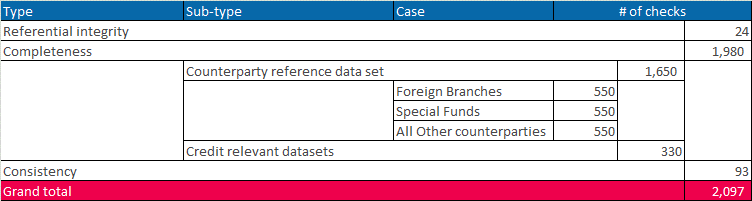

At its heart, AnaCredit requires monetary financial institutions (MFIs) to submit 88 contract level attributes on their banking book loans, and this is without taking identifiers into account. A total of 72 need to be reported monthly and 16 on a quarterly basis. To ensure the quality of the data the ECB has defined more than 2,000 validation rules for consistency, completeness and referential integrity as per table 1. Many national central banks (NCBs) have also added to the number of attributes and validation checks.

Table 1: Summary of the validation rules defined by the ECB

This level of data validation is unheard-of for this scope of financial products at this level of detail and frequency of reporting. Which means the data firms need to submit to their NCBs is a great source for internal risk management and business intelligence insight. MFIs would be making a serious mistake if they failed to capitalise on this.

However, MFIs do need to be cautious. Data might have passed a large number of validation checks that have been defined, but is it really correct? What if nominal amounts or fair values being reported are of the wrong magnitude? What if interest rates being specified are not correct? What if deal dates are also being reported inaccurately? What if the accounting classification of assets hasn’t been mapped correctly? Data that has been inaccurately specified can still pass validation checks.

Whilst the ECB has defined many validation rules, there are still several credibility checks that an MFI should do prior to submission. These are needed so the MFI can attest that once aggregated, the contract level data does reflect their balance sheet (assets).

Following on the point made above, it becomes obvious that there is a need for AnaCredit solutions to comply with BCBS 239 – Principles for Effective Risk Data Aggregation.

Data analysts and regulatory reporting professionals are used to dealing with aggregated data, not loan-by-loan details. They would deal with information at the line of business, country, region, portfolio and balance sheet level. They wouldn’t need to try to assess if each one of their MFIs’ 100,000+ loans are accurately reported, attribute-by-attribute. It’s just not humanly possible.

For years, MFIs have invested large sums in building out their reporting framework, but they have never had to define their data quality checks in such a level of detail. We have seen this through many AnaCredit projects where completeness of data has been the number 1 challenge to date before even considering quality. However, for AnaCredit projects both are paramount.

As such in 2018, firms will have at their disposal a huge pool of the highest quality data that is also submitted to their regulator. This pool will also grow over time as more submissions are prepared and made. In addition, the pool will also expand as Stages 2 and 3 of AnaCredit are defined over the next few years. So what can firms do with this massive pool of high quality, consistent data? The answer is “rather a lot”.

For data points that are similar to those used in current risk and reporting systems, the AnaCredit attributes could be retrofitted. Conceptually speaking, this should work, however unpicking existing solutions attribute by attribute in order to cherry pick better quality data from AnaCredit projects can also be rather difficult. In addition, MFIs would have to deal with the impact of a definitional change on time-series analysis – which can be tricky.

Given that Stages 2 and 3 of AnaCredit will soon be defined, it’s worth considering building analytic capability directly on top of a MFIs AnaCredit solution. Looking solely at the attributes and measures being reported, a vast amount of analysis and analytic capability can be delivered, without making this a complex project. For example, a business intelligence reporting suite can sit on top of customers’ AnaCredit data, providing MFIs with analytic insight not only with respect to AnaCredit, but also with a level 2 analysis which supports data quality checks across their statistical and prudential submissions in general.

While firms are focused on compliance, they should also take the time to look at the big picture, including the technology infrastructure in place to help with the task at hand. Having spent a reasonable amount of time, money and resources on satisfying the highly granular and specific requirements of AnaCredit, there are simple steps MFIs can take to turn this cost into a benefit.

After all, it is the same data that the ECB will use to support decision-making in monetary policy and macroprudential supervision, so it’s key that individual firms take advantage of this data, too.