Mastercard and Ethoca deliver greater transparency in digital banking applications

Mastercard and Ethoca are collaborating with merchants and financial institutions to include logos in digital banking applications.

As more businesses turn to digital payments, and the number of connected devices grows, one thing is becoming increasingly clear: consumers are demanding more clarity around what they bought and who they bought it from. Research shows that almost a quarter of disputes could be prevented with more details.

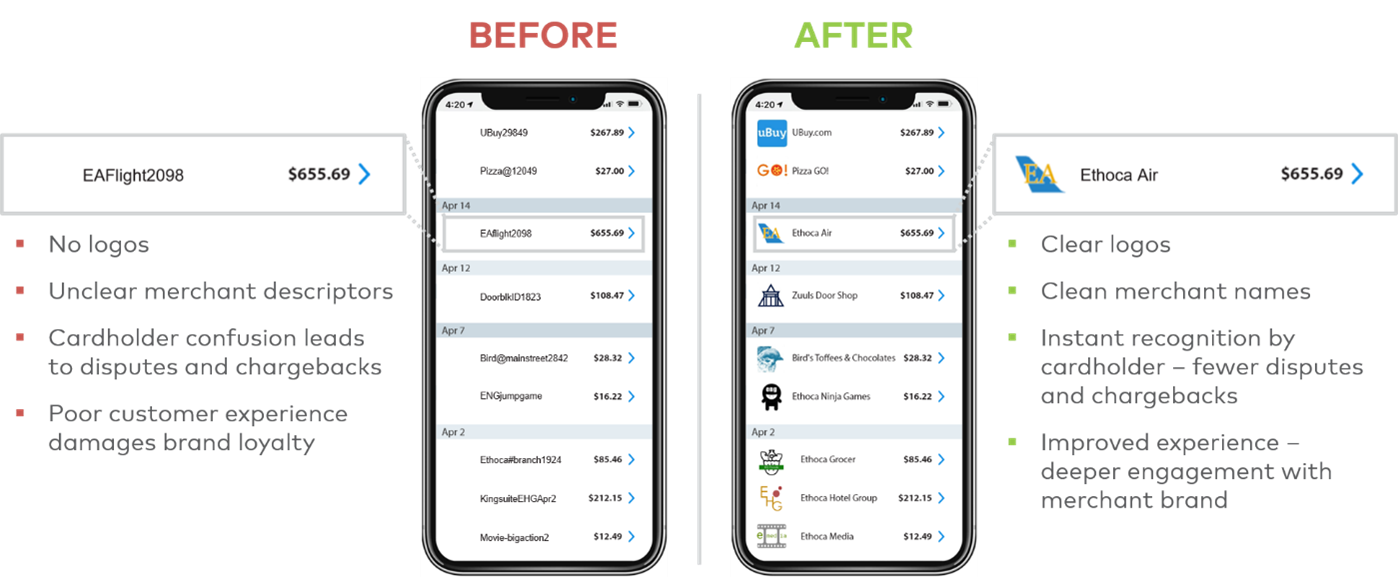

Most everyone has experienced the frustration of trying to decipher confusing and brief purchase descriptions when reviewing online statements. This confusion forces cardholders to contact their banks unnecessarily to dispute unrecognized transactions, adding extra steps for consumers and generating an array of costs for merchants and banks.

A new initiative from Mastercard and managed by Ethoca, the company’s collaborative fraud and dispute resolution technology, aims to eliminate this confusion and improve the customer experience. All merchants are encouraged to visit logo.ethoca.com and upload their logos for inclusion in online banking and payment apps. The merchant logos will be linked to corresponding transactions, adding clear visual cues to help cardholders quickly identify legitimate purchases. Participating merchants are provided an opportunity to simultaneously extend their brand presence as well as eliminate expensive and time-consuming chargebacks. This program is also available to all financial institutions.

A recent Ethoca-commissioned Aite Group study of the US market revealed that 96% of consumers want more details that help them easily recognise purchases, and nearly 25% of all transaction disputes could be avoided by delivering these details – including logos. It’s estimated that global chargeback volume will reach 615 million by 2021, fuelled in large part by frustrated consumers turning to the dispute process unintentionally.

“With greater digital dependency, having real-time purchase details is critical for consumers, merchants and card issuers alike,” said Johan Gerber, executive vice president, cyber and security products at Mastercard. “We continue to collaborate with industry partners to bring clarity and simplicity before, during, and after transactions. By enriching transaction details, merchants can alleviate friendly fraud, reduce chargebacks and improve the customer experience.”

This endeavour is part of comprehensive efforts to deliver the most efficient, safe, and simple payment experience from the minute a consumer begins browsing to once they’ve made the purchase. This includes Click to Pay, Mastercard’s one-click checkout experience, to the integration of biometrics to secure both digital and physical transactions, and Ethoca’s full suite of consumer digital experience solutions.