New UK banking hopeful Tryllian targeting 150m member figure

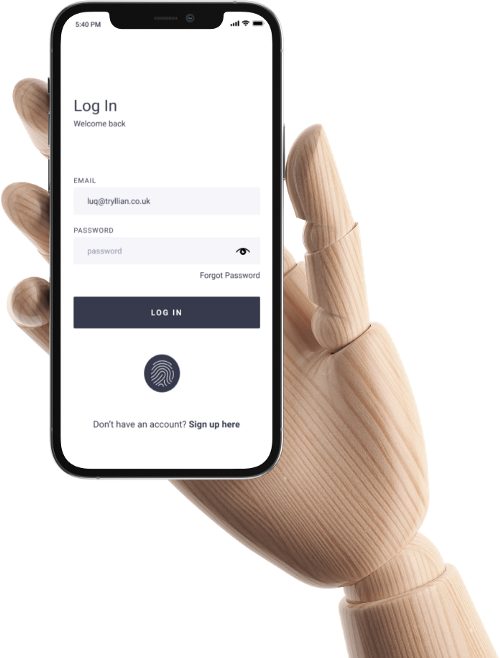

New UK-based challenger Tryllian Bank is aiming to connect with teenagers, underbanked peoples, and small businesses in Europe, Asia, and the US.

The firm, which plans to offer insurance, banking, and investment capabilities, is in the process of an application with the Financial Conduct Authority (FCA).

In a blog post about its upcoming launch, the firm says it has set its target at 150 million members. “Our ambition is a tall order,” it states. “Global ambition of this calibre is key to our success.”

It will offer users a free account, as well as a virtual and physical debit card.

Still in the waiting list stage, the banking hopeful says it will grant users access to stock exchanges across the globe, and provide options for a range of insurance products.

On its website, the bank says it plans to start out as an electronic money institution (EMI) before transitioning to a full banking licence.

Tryllian is led by founder and CEO Luqmaan Samie. A former CEO at A-List Group Holdings, Samie founded UK-based Samie Bank in 2020.

Samie also leads Samie Capital. In 2015, the group raised £1.9 million in a pre-seed funding round, but has since reported no further raises.

Incorporated in September 2020 with $560,000 of capital, Samie Bank claimed to have accrued 500,000 future customer accounts within days.

Some pages of Samie Bank’s original website are active, though many of its links now redirect to Tryllian.

Tryllian Bank registered with Companies House in August 2021, with £1,000 of share capital.