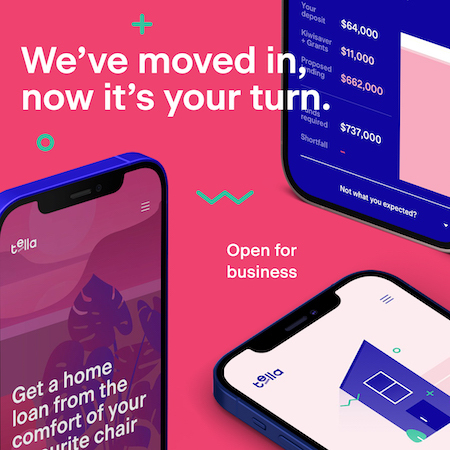

New Zealand gets first digital home loan platform Tella

A new online mortgage broker platform, Tella, has launched in New Zealand. The start-up says it’s the country’s first digital home loan platform.

Tella launches in New Zealand

Tella is an API-led digital platform for home loan applications, verification and approvals that aims to bring change to an industry “known for its manual and process-heavy approach”.

The fintech platform says it is designed for a tech-savvy audience who are comfortable online. Users can also access an education component within the platform to make “informed and confident” financial decisions.

Tella adds that through its platform, customers can view home loan options across a range of lenders, as opposed to going to a bank, where one can only view their options.

The platform works with multiple banks and non-bank lenders, who pay a commission to Tella, to provide a range of interest rates and borrower terms.

“As a fintech-driven business, innovation is built into our DNA,” says Stephane Mathieu, founder and director of Tella. “But we’re using it to transform what can otherwise be an intimidating experience for home buyers.

“Our focus on fintech makes it easier for them to navigate the process themselves, but the Tella team will always be there to help them on their home loan journey with a range of accessible support options and tools.”