Banking Tech Awards USA 2022 Winner: Hamilton Reserve Bank – Best Use of Risk, Compliance & Fraud Protection Technology

Hamilton Reserve Bank and authID expound on the benefits of seamless and secure digital identity assurance.

authID’s biometric identity proofing and multi-factor authentication has helped Hamilton Reserve Bank (HRB) reduce the risk of identity fraud, mitigate password risk, and deliver seamless banking experiences that are trusted by HRB’s loyal customers.

Launched in 2021, HRB’s new digital Temenos banking platform was designed specifically to expand its global portfolio of high-net-worth customers and provide enhanced security.

HRB uses authID’s multi-factor, cloud-based biometric authentication technology to create a customer journey that is secure and seamless throughout, reinforcing the bank’s reputation for security and trust. It also meets best practices in anti-money laundering (AML), know your customer (KYC), and countering the financing of terrorism (CFT) compliance, as well as PSD2 regulations.

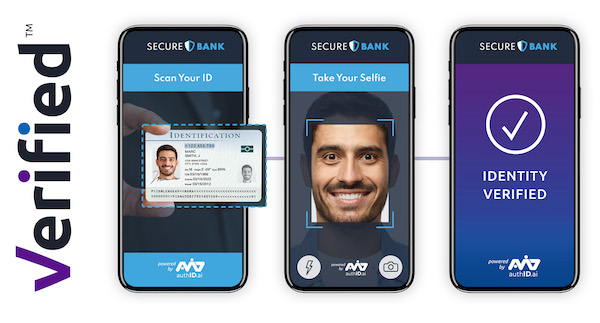

With the simplicity of a photo ID and facial biometric identity proofing, customers can establish a trusted identity that can be used anywhere, anytime they bank with HRB. authID’s flagship solution, Verified, allows customers to avoid the use of vulnerable one-time passwords and knowledge-based questions and instead use a “selfie” that is bound to their proofed identity to authenticate login and confirm valuable account transactions.

“authID’s biometrics allow financial institutions like HRB to speed up customer conversion and secure the entire customer journey by allowing the identity verified at onboarding to help them defend against password risks and fraudulent account takeovers, lower enterprise support costs, and increase customer loyalty,” says Jeremiah Mason, senior vice president of product for authID.

HRB’s CFO, Antonio Kenyatta explains that their new digital onboarding process needed to be cutting-edge enough to provide a “wow” effect, but also simple and intuitive for all new customers.

“As part of our bank’s digital transformation strategy, we outlined the need to address new account onboarding. In creating a digital solution, we streamlined the online customer application process for both retail and business accounts, and reduced client onboarding time,” says Anthony Gajor, executive vice president, global business development.

The result is a digital onboarding experience that is both satisfying and safe for customers. The process is significantly shorter, and customers can use any mobile or desktop browser to quickly capture their identity document and snap their selfie.

The selfie means that at the start of the customer journey, biometrics strengthen the bank’s digital onboarding. And during automated remote account opening, authID’s Verified provides strong biometric identity verification, thereby eliminating paper-driven account applications. Verified leverages artificial intelligence (AI) to power anti-spoofing liveness confirmation and biometric matching of a selfie to authenticated credentials.

“Our onboarding process is user friendly and takes just minutes. But, as importantly we can now stop fraudulent account openings at the front door,” says Kenyatta.

Indeed, the bank has also leveraged authID to take out the risks and costs of passwords. It now offers its customers seamless, FIDO2-certified passwordless login to their online banking portal. Using authID’s patent-pending process, FIDO login is biometrically bound to the identity verified at onboarding.

“Delivering strong customer authentication that combines ‘something you are’ with ‘something you have’ authentication factors establishes a digital chain of trust between users, their accounts, and their devices,” says Mason.

With biometric, passwordless authentication, any assumptions of “who” performed a transaction are eliminated, establishing trust and certainty in the user identity verification process. This enables banks and financial institutions to prevent and mitigate the damage of fraudulent account takeover attempts.

“We now have robust defence against phishing and smishing attacks, where customers are targeted to provide their account login details. We also did away with knowledge-based questions/answers and one-time passcodes that are vulnerable to hijacking. Biometrics also reduces the risk of credential-stuffing attacks, account takeovers, and friendly fraud,” says Anthony Gajor.

According to HRB, fraud risk was minimised by 23% and customer help desk support costs were decreased by 67% after implementing authID’s Verified solution. The bank also reduced retail customer onboarding time down to just minutes, as opposed to days or weeks, as well as corporate customer onboarding down to an average of two days, from weeks or even months.

Once inside the platform, customers and their HRB accounts are protected by authID’s privacy-first facial biometric multi-factor authentication, again linked to the identity verified during onboarding. In practice, this means the customer takes a quick, “live” selfie, and Verified then authenticates their identity for outgoing Swift wires, customer account beneficiary changes, and password resets, thereby eliminating easily compromised legacy authentication methods.

The bank is planning for exponential growth and onboarding of at least one million new customers over the next year, and the platform secured by authID’s technology will contribute significantly to attracting and retaining customers.