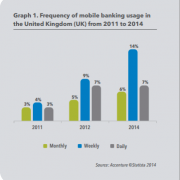

One in five UK bank accounts hit by cybercrime

One in five UK consumers (21%) have had personal details stolen and their bank accounts used to buy goods and services as a result of a cyber security breach, according to new research from business advisory firm Deloitte.