Lay-off plans dampen optimism in FS jobs market

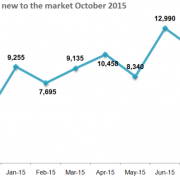

The news of major lay-offs to come put a dampener on otherwise good news in the financial sector jobs market in the UK last month. According to the Morgan McKinley London Employment Monitor, October saw an across the board increase in both new job opportunities and new job seekers.