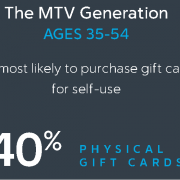

Study: Big Box Stores, Plastic Cards Dominate in Loyalty, Corporate Rewards

In a sign that many consumers use gift cards to purchase everyday household items, big box retailers continue to lead loyalty points and rewards redemptions in the U.S., according to a new study from the National Gift Card Corp. (NGC).