Get Smart: BofAML Brings AI to Accounts Receivable

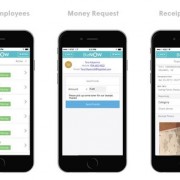

Bank of America Merrill Lynch is launching a new solution—Intelligent Receivables—that uses artificial intelligence (AI) and other software to help companies “vastly improve” their straight-through reconciliation of incoming payments to help them post their receivables faster.