Worldwide

Blog: With iOS 7 and AirDrop, Apple Moves to Kill NFC, Dominate Mobile Commerce

If you believe that Apple will support near field communications (NFC) on its next iPhone, it’s time to give up on that hope.

Doubts cloud UK Treasury retail competition plans

UK Treasury officials and senior bank representatives showed diverging views over the future of retail banking at an event hosted by Experian in London yesterday, revealing differences of opinion about how best to reform the sector.

New CHAPS mechanism reduces intraday liquidity demands on members

A new Liquidity Savings Mechanism for CHAPS clearing members is showing significant improvement in liquidity efficiency after its first two months of operation. Members of the CHAPS Clearing Company, the organisation responsible for the operation of the UK’s same-day high-value payment system, began using the new LSM in April. Developed by the Bank of England, […]

Next Level: the changing securities market

Cover story: the securities markets are changing rapidly, and none more so than fixed income. Also in this issue: Interview: Thomas Zeeb, chief executive of Six Securities Services, on the opportunities presented by Europe’s changing post-trade infrastructure Interview: Ruth Wandhöfer, global head, regulatory & market strategy at Citi Transaction Services, on the challenges still facing […]

Accounting for the value of (big) data

While the value of data has become increasingly clear to businesses in the wake of the financial crisis and subsequent regulatory and compliance initiatives across Europe, they are not yet reflecting data as a valued asset on their balance sheets.

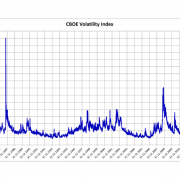

Tradition reveals Volatis volatility trading service

Interdealer broker Tradition has released a new hybrid trading service for volatility futures, Volatis, which aims to improve transparency, liquidity and participation in volatility futures.

Risk data aggregation: forming the view from nowhere

The deadline for firms to upgrade their risk data aggregation capabilities is fast approaching. Without a consolidated viewpoint on what new risk data requirements mean, they will be at a loss when it comes to determining best practice …

MoneyGram forges deal with Lebara Mobile for international money transfers

MoneyGram has forged a deal with European mobile telecom operator Lebara Mobile.

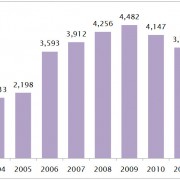

London financial jobs scene showing upward trend

The number of new financial services jobs available in London during May was 20% over the previous month and recruitment specialists say that the trend is upwards, but the number of new jobs in May was 59% down compared to the same period last year.

Apple Grows Payments Patent War Chest (June 10, 2013)

Just days before Apple’s annual Worldwide Developers Conference, which runs all this week in San Francisco, the U.S. Patent and Trademark Office (USPTO) has granted Apple another patent that could be a signal of what the tech giant is planning for mobile payments. The patent relates to a “method and system for managing credits […]

Green Dot to Replace GE Capital as Walmart MoneyCard Issuer (June 10, 2013)

Green Dot Corp. will benefit from its exempt status from debit interchange caps by becoming the issuer of one of the largest GPR programs on the market—the Walmart MoneyCard. Green Dot Bank, which also serves as the issuer for Green Dot’s GPR cards, replaces GE Capital Retail Bank, which is bowing out of the relationship […]

Making cross-border payments work

As the value of global cross-border payments such as workers’ remittances increases, billions of dollars are being lost to inefficient legacy systems – but that could be about to change, according to Hank Uberoi, executive director at Earthport.

Nasdaq OMX NLX reinforces pricing proposition

New London derivatives market Nasdaq OMX NLX has partnered with technology specialist SuperDerivatives in a bid to ensure its pricing is as sound as possible, ahead of its looming battle to take business from its European derivatives rivals.

GFT moves into Italian market with Sempla acquisition

GFT Technologies has taken an 80% stake in Italian IT consultancy Sempla for an undisclosed cash sum. It has the option to acquire the remainder of the company after five years.

Nationwide installs NCR anti-fraud tools on its ATMs

Nationwide Building Society has brought in a new tool from ATM maker NCR designed to protect its customers against card-skimming, a type of fraud in which criminals steal customer data from ATMs.

How high? Re-setting the KYC bar

Regulators are busy raising the bar for KYC systems and controls. With conflicting purposes and customer data objectives, new guidance and industry solutions are needed in 2014

Joining the dots: Thomas Zeeb, chief executive, Six Securities Services

The post-trade infrastructures behind the world’s securities markets face as much, if not more, regulatory driven change as the trading firms in the face of legislation such as the European Union’s European Market Infrastructure Regulation. While some of the effects will be negative, the regulators are showing a constructive approach and recognising that the infrastructure providers came out of the crisis well, says Thomas Zeeb, chief executive of Six Securities Services.

TriOptima tool targets OTC derivatives reporting business

As new rules governing the central reporting of OTC derivatives take effect across the G20 nations, TriOptima, a subsidiary of broker ICAP, has said it will verify and reconcile OTC derivatives data from US post-trade utility the DTCC’s trade repository – making it the first provider to do so.

Nasdaq OMX to monitor US platform performance with CorvilNet

Nasdaq OMX plans to implement operational performance monitoring across its US trading platforms using software from Corvil. The CorvilNet performance monitoring system will provide the exchange group with the ability to simultaneously analyse activity at the network, application and trading layers. The information that is captured will allow it to alert for anomalies in real […]

Tescher: ‘Set Up People for Success’ (June 6, 2013)

During the opening keynote address at the Underbanked Financial Services Forum, which kicked off yesterday in Miami, CFSI President and CEO Jennifer Tescher suggested that conference attendees view themselves as being in the financial health business. Drawing heavily on analogies to the health care industry throughout her address, Tescher explained that the American psyche is […]

Bell ID releases secure cloud NFC tool

Dutch software company Bell ID has released a new tool that aims to simplify the provision of NFC mobile services, including mobile payment. The firm’s secure element in the cloud manages keys, certificates and NFC credentials in a remote environment rather than in the mobile device; the idea is to provide app issuers with the […]

Temenos: moving beyond the core

The extent to which a targeted series of acquisitions over the past few years have moved Temenos from being simply a core banking system vendor to a fully-fledged financial technology specialist became clear at its recent annual user event, this year held in Abu Dhabi.

The gathering storm

Recent months have seen rising tensions over the seemingly insurmountable demands for collateral prompted by tough new financial regulation. With US Treasury estimates ranging as high as to $11.2 trillion in stressed market conditions, some observers are deeply concerned that the industry could be in danger of sliding into a black hole

PayPal and Its Quest for Ubiquity (June 2013)

E-commerce is still PayPal’s bread and butter, but the company is making serious strides at brick-and-mortar stores.

Brokers must outsource technology to survive says report

Brokers need to cut back costs radically, reducing staff numbers and even casting aside parts of their equity business that were once considered core, according to new research by analyst firm Celent.

Pressure on financial innovation shown by drop in patent applications

Innovation in financial services is currently at a seven-year low, reflecting a period of cost-cutting and scaling back in the face of new financial regulation – but innovative new technologies such as mobile may provide a solution, according to law firm RPC.